Loan facility of JEEVAN SHANTI POLICY will be available after completion of one policy year and will be available under the following

annuity options only:

a) Immediate Annuity:

i. Option F – Immediate Annuity with return of Purchase Price

ii. Option J – Joint Life Annuity with 100% Annuity to last survivor and return of Purchase price.

b) Deferred annuity–

i. Option 1: Deferred annuity for Single life.

ii. Option 2: Deferred annuity for Joint life.

Under Deferred Annuity during Deferment period:

Maximum amount of loan available will be such that the annual interest amount payable on loan shall not

increase 50% of the annual annuity amount payable under the policy after deferment period and shall be

subject to maximum 80% of Surrender Value.

Loan interest during deferment period shall be paid on compounding half yearly basis.

In case loan is not repaid during the deferment period and if there is no default in interest payment as at

end of deferment period, then interest on loan shall be recovered from the annuity amount payable after the deferment period.

In case loan is not repaid during the deferment period and there is a default in interest payment as at end

of deferment period, the difference of surrender value and loan outstanding along with interest shall be

payable to Primary / Secondary annuitant and policy shall be terminated.

During the deferment period, if interest is not paid on due dates and when the outstanding loan amount

along with interest exceeds the surrender value, the policy shall be forfeited and difference of surrender

value and loan outstanding along interest shall be payable to Primary / Secondary annuitant and policy

shall be terminated.

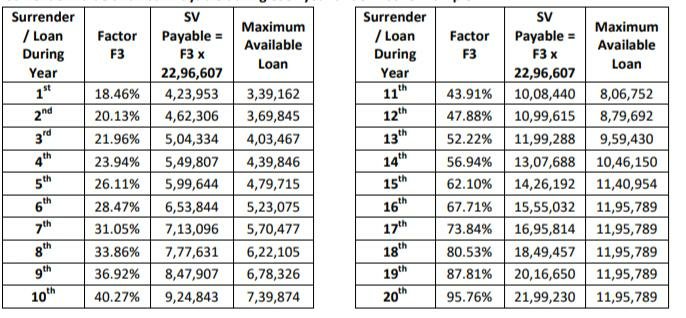

Example:

Age at Entry: 45 years,

Purchase Price – 10,00,000, Deferment Period – 20 years.

Annual Annuity Payable – 2,27,200, Loan Interest rate – 9.50%

Calculate Loan amount during 4th Year of policy:

50% of Annuity – 2,27,200 / 2 = 1,13,600

Loan Amount = 50% of annuity x 100 / Loan interest rate

= 1,13,600 x 100 / 9.50

= 11,95,789

Surrender Value During 4th year of Policy: 5,49,807

Loan Amount will be restricted to 80% of SV i.e. 80% of 5,49,807 = 4,39,846.

Under Immediate Annuity and Deferred Annuity after Deferment Period:

Maximum amount of loan available will be such that the annual interest amount payable on loan shall not

increase 50% of the annual annuity amount payable under the policy and shall be subject to maximum

80% of Surrender Value.

Loan interest will be recovered from the annuity amount payable under the policy.

Loan interest will accrue as per frequency of the annuity payment under the policy and will be due on the due date of annuity.

Outstanding loan amount will be recovered from the claim proceeds at the time of exit.

Example:

Age at Entry Single/Primary annuitant: 45 years, Secondary Annuitant – 35 years.

Purchase Price – 10,00,000, Deferment Period – 20 years, Loan Interest rate – 9.50%

Calculate Loan amount during 4th Year of policy under:

a) Under Option F of Immediate Annuity and

b) Option 2 of Deferred Annuity

a) Under Option F of Immediate Annuity:

Annuity Payable Per Annum = 65,400

50% of Annuity – 65,400 / 2 = 32,700

Loan Amount = 50% of annuity x 100 / Loan interest rate

= 32,700 x 100 /9.5

= 3,44,210

Surrender Value During 4th year of Policy: 7,48,488

80% of SV = 0.80 x 7,48,488 = 5,98,790

Maximum Available Loan will be = 3,44,210.

b) Under option 2 of Deferred Annuity:

Annuity Payable Per Annum = 2,27,200

50% of Annuity – 2,27,200 / 2 = 1,13,600

Loan Amount = 50% of annuity x 100 / Loan interest rate

= 1,13,600 x 100 /9.5

= 11,95,789

Surrender Value During 4th

year after Vesting: 22,52,448

80% of SV = 0.80 x 22,52,448 = 18,01,958

Maximum Available Loan will be = 11,95,789.

1. Jeevan shanti policy can be surrendered at any time after three months from the Date of issuance of policy or after expiry of the free-look period, whichever is later.

1. Jeevan shanti policy can be surrendered at any time after three months from the Date of issuance of policy or after expiry of the free-look period, whichever is later.