Introduction

Paying your LIC premium has never been easier, thanks to the convenience of online payment options. And with Paytm, the process becomes even more streamlined and hassle-free. In this article, we will guide you on how to make LIC premium payment online Paytm. We will also answer some common questions that you may have about the process. So, let’s get started!

How to Make LIC Premium Payment Online Paytm

Here are the steps to follow to make LIC premium payment online Paytm:

First, visit the Paytm website or open the Paytm app on your mobile phone.

Select the ‘Insurance’ option from the menu.

Choose ‘Life Insurance Corporation of India (LIC)’ as your insurance provider.

Enter your policy number and other relevant details.

Check the details once again and proceed to make the payment.

Select your preferred payment method – credit card, debit card, net banking, or Paytm wallet.

Enter the payment details and confirm the transaction.

You will receive a confirmation message and an email with the transaction details.

It’s that simple! You can now enjoy the convenience of paying your LIC premium online with Paytm. You can also set up a standing instruction to ensure that your premium payments are automatically deducted from your account each month.

Advantages of LIC Premium Payment Online Paytm

There are several benefits of making LIC premium payment online Paytm. Here are a few of them:

Convenience: You can pay your LIC premium anytime, anywhere, without having to visit the LIC office or a bank branch.

Time-saving: Online payment options like Paytm save you the time and effort of standing in long queues or filling out cumbersome paperwork.

Security: Online payments are secure and protected by encryption and other security measures.

Instant confirmation: You receive instant confirmation of your payment, which gives you peace of mind.

Easy tracking: You can easily track your payment history and other details on the Paytm app or website.

FAQs

Is it safe to make LIC premium payment online Paytm?

Yes, online payments on Paytm are secure and protected by encryption and other security measures. You can trust Paytm to keep your information safe and secure.

Can I use Paytm to pay for other insurance policies besides LIC?

Yes, you can use Paytm to pay for a wide range of insurance policies from different providers.

What if I make a mistake while entering my policy details on Paytm?

Don’t worry! You can always edit your details before making the payment. You can also cancel the transaction and start again if you need to.

Can I set up automatic deductions for my LIC premium payments on Paytm?

Yes, you can set up a standing instruction to ensure that your LIC premium payments are automatically deducted from your account each month.

What if I face any issues while making LIC premium payment online Paytm?

If you face any issues while making LIC premium payment online Paytm, you can contact Paytm customer support for assistance.

Conclusion

Paying your LIC premium online with Paytm is a convenient and hassle-free option.

You can save time and effort, enjoy secure transactions, and receive instant confirmation of your payment.

By following the simple steps we have outlined in this article, you can easily make LIC premium payment online Paytm.

So, go ahead and simplify your life with Paytm!

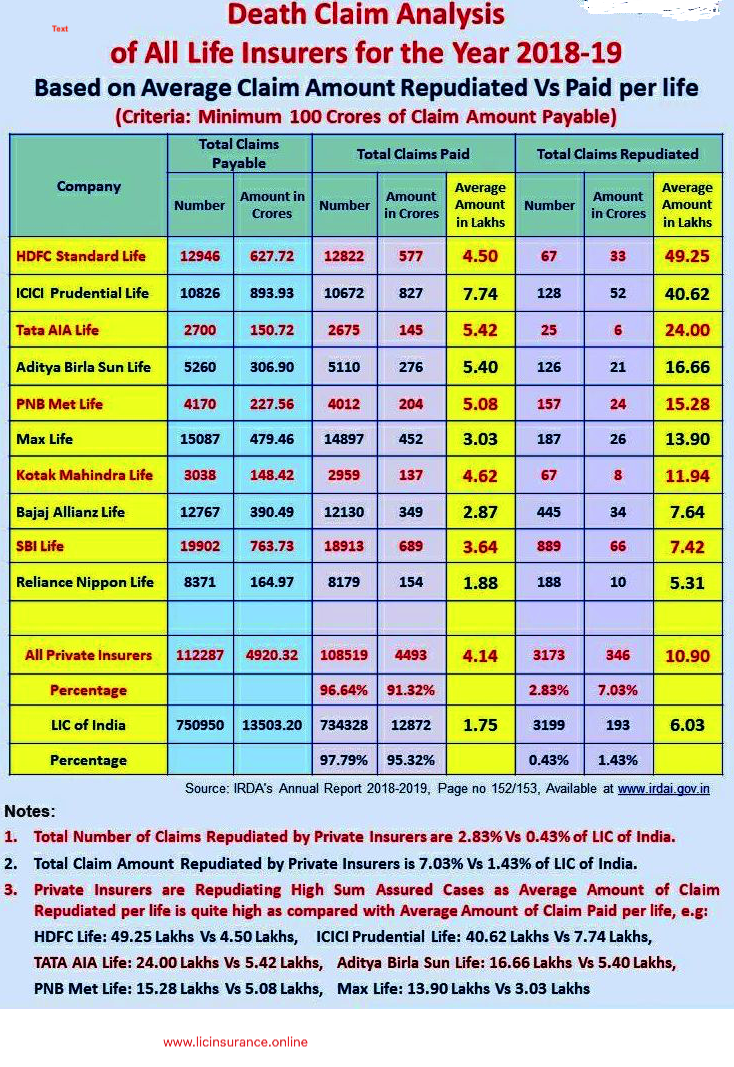

REPUDIATION:

REPUDIATION: HDFC: 49.25 Lacs

HDFC: 49.25 Lacs

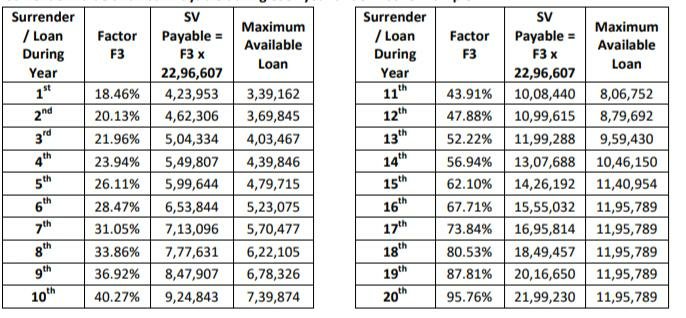

1. Jeevan shanti policy can be surrendered at any time after three months from the Date of issuance of policy or after expiry of the free-look period, whichever is later.

1. Jeevan shanti policy can be surrendered at any time after three months from the Date of issuance of policy or after expiry of the free-look period, whichever is later.