NEW PRADHAN MANTRI VAYA VANDANA YOJANA

PRADHAN MANTRI VAYA VANDANA YOJANA (PMVVY LIC policy) is a pension plan which is Government subsidised scheme and it will provide assured returns of 8% per annum.Its a Government Pension scheme for senior citizen of India .

PMVVY LIC scheme has announced by our PM Sri Narendra Modi form LAL KILA. LIC is just a distribution channel of this PMVVY policy.

If it is payable on monthly basis (effective yield would be 8.30% p.a.).

PRADHAN MANTRI VAYA VANDANA YOJANA is a surviving policy term of 10 years.Means it is a 10yrs term plan.Basically it is a Government Pension Scheme but only distribution part is with LIC of India.Pensioner has an option to choose either the amount of pension or the Purchase Price.Purchase price is the lumsum amount , what you want to put in LIC to secure your pension.

Purchase Price will be accepted by cheque/drafts payable on the Bank Branch which is member of local/CTS/Speed Clearing Centre. Pension will be paid via NEFT/ Aadhar Enabled Payment System.Conditions for Pradhan Mantri Vaya Vandana Yojana.

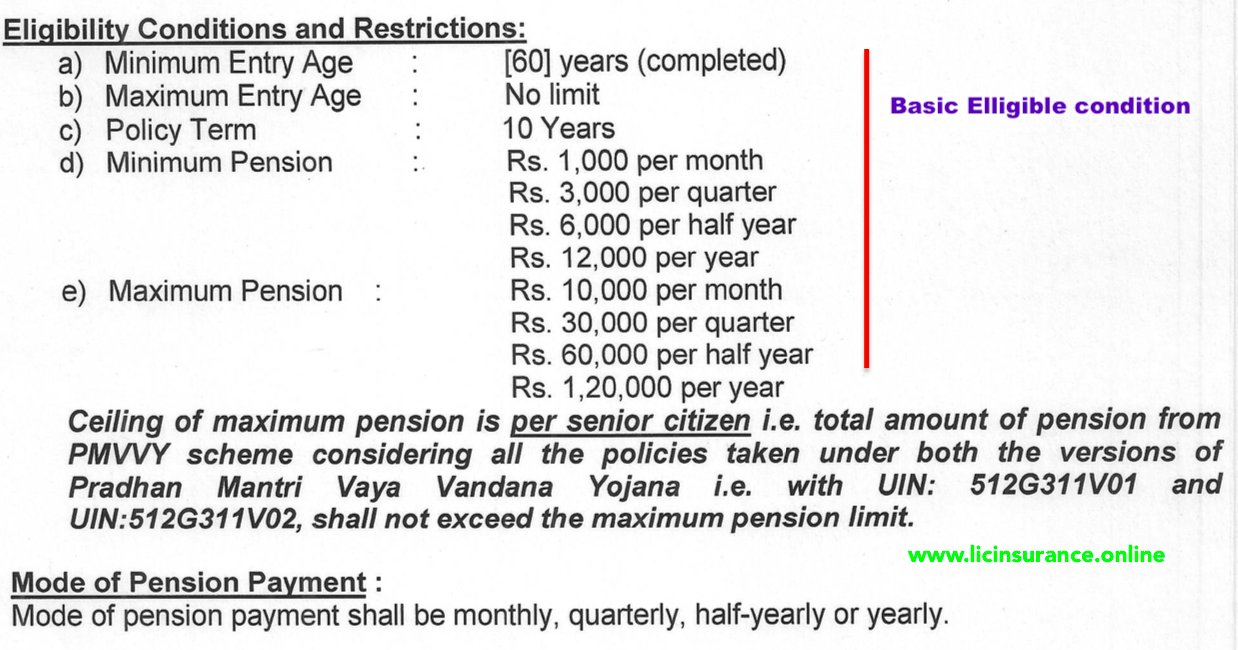

There are few conditions for Pradhan Mantri Vaya Vandana Yojana.

Like

- Minimum amount of pension should be Rs 1000 per month and Maximum pension should be Rs 10000 per month per Sr. Citizen including pension opted under earlier PMVVY scheme.

- Minimum amount should be deposited Rs 144578 one time ,so that ate rate 8% return will Rs 12000 yearly.

- Maximum amount should not cross Rs 15 lac per Sr.Citizen.Age of Sr Citizen should be minimum 60 years.

PMVVPY LIC Eligible Condition

[PMVVPY LIC Elligible Condition]

[PMVVPY LIC Elligible Condition]

Benefits Of New PMVV

Pension Payable:

Pension in form of immediate annuity will be paid in arrears (at the end of each period) as per mode chosen by the pensioner on his/her survival during policy term.

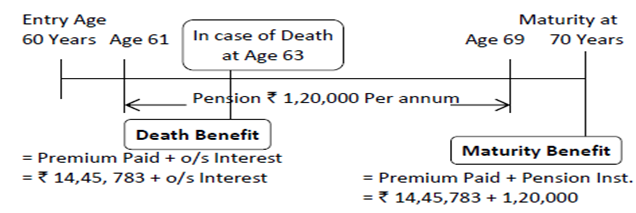

- Death Benefit: Purchase Price along with interest for the period from last installment of pension to date of death will be payable.

- Maturity Benefit: Purchase Price and final Pension installment.