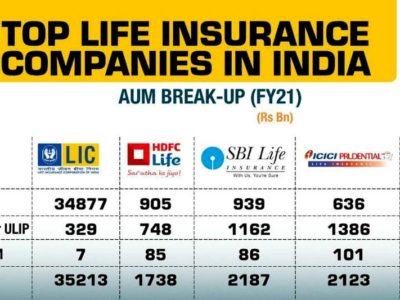

LIC IPO Detail and Info

LIC IPO ISSUE INFORMATION

Its a long awaited wait is going to end soon , When LIC will launch IPO for customer and public. Finally a tentative date and details has come.

- 07th March – Announcement of Price Band

- 09th March – Anchor Investors Allotment

- 10th March – Offer Opens

- 14th March – Offer Closes

- 17th March – Finalisation of Basis of Allotment

- 21st March – Unblocking of ASBA Accounts

- 22nd March – Credit of Equity Shares to Depository Accounts

- 23rd March – Commencement of Trading.

- Issue Opens on: 10 March 2022

- Issue Closes on: 14 March 2022

- Issue Type: Book Built Issue IPO

- Issue Size: 31,62,49,885 Shares

- Face Value: Rs.10/- per Share

- Issue Price: Rs.2,000 – Rs.2,100 Share

- Discount: 10% (for Employees & Policy Holders)

- Market Lot: 7 Shares

- Listing At: NSE, BSE

Equity Shares outstanding prior to the Issue = 6,32,49,97,701 Shares

Fresh Issue of NIL Shares @2,100/- = Rs. NIL Crs

Offer for Sale of 31,62,49,885 Shares @2,100/- = Rs.*65.416.29Crs

(*considering 10% discount for Employees & Policyholders)

Equity Shares outstanding after the Issue = 6,32,49,97,701 Shares

How LIC CUSTOMER (Policy holder) can get discounted IPO shares?

- DMAT account is compulsory :As per SEBI ICDR Regulation Policy holder must have DMAT account to apply for shares in the offer of LIC IPO, because no physical form of share will be issued by LIC.

- Is there any minimum balance of equity shares to be kept in the demat account?

No minimum balance is required like in demat account. - Policy holder must have LIC policies ,Other insurer’s Policy holder has no meaning .

Example: I am having a policy in SBI Life Insurance. Can I apply for the Equity Shares of the Corporation in the Offer under the Policyholder Reservation Portion category?

No, Bidding under the Policyholder Reservation Portion is only for policyholders of our Corporation. - However, one can apply under RIB or Non-Institutional Bidders category.

- What is minimum number of Equity Shares for which the policyholders need to apply?

There is a minimum number of Equity Shares (x) that will have to be applied under the Offer in respect of all categories. Hence, Eligible Policyholder(s) also have to apply for the said minimum x number of Equity Shares, as specified in the Offer Documents. - What is the maximum amount which Eligible Policyholder(s) can apply under Policyholder Reservation Portion?

Eligible Policyholder(s) can apply for such number of Equity Shares in multiples of ___________Equity Shares such that the Bid Amount does not exceed ?200,000 (net of Policyholder Discount). - For Joint Life Policy holder of LIC :

Only one of the two can apply for the Equity Shares under the Policyholder Reservation Portion category.

The PAN number of the applicant Bidding in the Offer (you or your spouse) needs to be updated in the policy records. The applicant has to have a demat account in his/ her name and in case the demat account is joint, the applicant needs to be the first /primary holder of the DMAT account.

NOTE : PAN number must be linked with LIC Policies ,Link or check PAN status https://licindia.in/Home/Online-PAN-Registration