LIC NEW PENTION PLAN JEEVAN SHANTI

This is non-linked, non-participating, Single Premium annuity plan which provides option for Immediate Annuity or Deferred Annuity. This plan is allowed to all lives including third gender.

The annuity rates are Guaranteed at the inception of policy for the life time under both options.

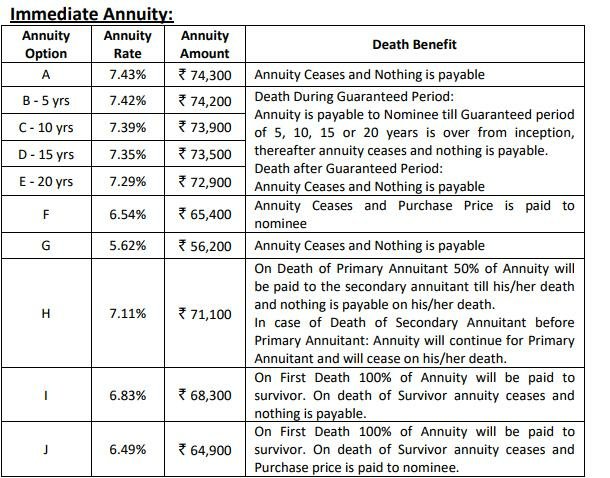

Type of Annuity Options under Immediate Annuity:

A. Annuity for life.

B to E. Annuity guaranteed for 5, 10, 15 or 20 years and for life thereafter.

F. Annuity for life with return of purchase price on death.

G. Annuity for life increasing at a simple rate of 3% p.a.

H. Joint life Annuity for life with a provision for 50% of the annuity to the secondary

annuitant for life on death of primary annuitant.

I. Joint life Annuity for life with a provision for 100% of the annuity payable as long as one

of the Annuitant survives.

J. Joint life Annuity for life with a provision of 100% of the annuity payable as long as one of

the Annuitant survives and return of purchase

Type of Annuity Options under Deferred Annuity:

There are two types of annuity options are available.

Option 1: Deferred Annuity for Single life

Option 2: Deferred Annuity for Joint life

Joint life annuitant under immediate/deferred annuity can be any lineal descendent/ascendant

(i.e. Grandparents, parents, Children, Grand Children) or spouse or sibling

Accrued Guaranteed Additions (GA)

Under Deferred Annuity:

GA shall accrue at the end of each policy month till the end of Deferred Period.

Rate of GA per month = (Purchase Price x Annuity rate p.a. payable monthly)/12

Annuity rate p.a. payable monthly = 0.96 x (Tabular Annuity rate as per age at entry of annuitant/s

and deferment period opted for) /1000

Death Benefit under Deferred Annuity:

Single Life – During and after Deferment Period:

Purchase Price + Accrued GA minus Total Annuity pay outs till date of death if any or 110% of

Purchase Price whichever is more is payable to nominee as per option selected.

Joint Life – During Deferment Period:

On First Death – Nothing is payable and on Death of Survivor Death benefit as applicable to

Single Life is payable as per option selected.

- Joint Life – After Deferment Period:

On First Death – 100% Annuity will be paid to survivor and on death of survivor Death benefit as

applicable to single life is payable as per option selected.

Options for Death Claim Payment to Nominees Under Immediate Annuity (Option F & J only) and both the options Under Deferred Annuity:

1. Lump Sum amount.

2. Immediate Annuity to nominee as per his/her age at prevailing annuity rates.

3. In 5, 10 or 15 instalments as per applicable rates.

In case of death any proportionate annuity from date of payment of last annuity till date of death is not payable under all options of Immediate / Deferred Annuity.

Maturity Benefit: There is no Maturity Benefit under the plan.

Benefit Example:

Age of Single/Primary Annuitant: 45 years ,

Purchase Price: Rs10,00,000

Annuity Mode: Yearly,

Deferment Period: 20 Years.

Age of Secondary Annuitant: 35 years (For Joint Life)

Features and conditions of Jeewan Shanti plan:

Minimum Purchase Price :Rs 1,50,000 Subject to

Minimum Annuity of Rs1,000 per month.

Maximum Purchase Price : No limit

Minimum age at entry : 30 years lbd for Single Life and both lives under Joint life.

Maximum age at entry Under Immediate Annuity for Jeevan Shanti:

- 100 years lbd under option F.

- 85 years lbd under all other options.

Under Deferred Annuity :

Maximum age at Entry : 79 years lbd

Minimum Deferent Period : 1 year

Maximum Deferment Period : 20 years

Minimum Vesting Age : 31 years lbd.

Maximum Vesting Age : 80 years lbd.

Mode of Payment: Single Premium only

Annuity mode: Yearly, Half-yly, Qly or Mly.

The first annuity instalment will start after one year, 6 months, 3 months or one month as per mode selected.

Example 1

Suppose

Mr/ : ABC took

Plan : Jeevan Shanti (850)

Selected Annuity Option : Deferred annuity for Single life

Age :45

Deferment Term :7 years

Sum Assured :Rs 1000000

Single Premium : Rs 1018000

Annuity payable:

Yearly : 104100

Halfly : 50980

Quarterly : 25223

Monthly : 8318

Now see Example for immediate Pention for LIFE TIME

Mr : ABC

Plan : Jeevan Shanti (850)

Annuity Option : [F] Immediate Annuity for life with return of Purchase Price

Age :45

Sum Assured : 1000000

Single Premium : 1018000

Annuity :

Yearly : 65400

Halfly : 32050

Quarterly : 15863

Monthly : 5250

Jeewan Shanti Plan is the best for

- Businessman,

- Retired person

- Entrepreneur

- Professional

- Irregular Income :like Actor, Farmer etc

Now this jeewan shanti is available for Employer -Employee scheme also.