New JEEVAN LABH LIC PLAN No 936, Benefits, Feature and Maturity

New LIC Jeevan Labh plan No 936

Earlier This LIC plan was named as Jeevan Labh Plan 836.Now New feature has been added and updated version has come.

It is an endowment plan with limited premium paying term,non-linked with equity but with profits plan which is a combination of risk cover and savings.

Jeevan Labh plan will give financial support for the family in case of premature death of the policyholder.If policy holder survives till the end of policy tern then he will get good amount as maturity.

Jeevan Labh plan also takes care of liquidity of policy holder through its loan and surrender facility. As per as LIC Agent concern its very sellable LIC product.

Benefits of New Jeevan Labh Policy

Death benefit :

In case of death in between of the policy term , Jeevan Labh provide a sum of “Sum Assured on Death”, plus vested Simple Reversionary Bonuses and Final Additional bonus.

Where, “Sum Assured on Death” is defined as the higher of 10 times of yearly premium or Absolute amount assured to be paid on death i.e. Basic Sum Assured . This death benefit should not be less than 105% of all the premiums paid by customer .

Premiums consider above shall not include any service taxes, extra amount chargeable under the policy due to underwriting decision and rider premium(s).

Maturity Benefit OF Jeevan Labh Policy

“Sum Assured on Maturity”+ vested Simple Reversionary bonuses + Final Additional bonus,

Optional Rider Benefit of Jeevan Labh :

The policyholder has an option of availing the following Rider benefit(s):

- LIC’s Accidental Death and Disability Benefit Rider

- LIC’s New Term Assurance Rider

Features Of New Jeevan Labh 936

Premium Payment Mode:Yearly, Halfly, Quarterly, Monthly(ECS) or NACH

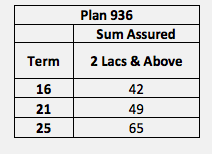

There are 3 Terms available in Jeevan Labh plan:

- 16 Year

- 21 Year

- 25 Year

PPT Premium payable term :

- For Term 16 Year Ppt 10 year

- For Term 21 Year Ppt 15 Year

- For Term 25 Year ppt 16 year

Minimum Entry Age :8 Year Completed

Maximum Entry Age :59 Year (Nearest Birthday)

Maximum Maturity Age :75 Year

Minimum Sum Assured :2,00,000

Maximum Sum Assured :NO LIMIT (Depending upon Income)

Maximum Accidental Death and Disability Benefit Rider up to age 70.

Policy Benefits :On Death :

Basic Sum-Assured,OR10 times of Annualized Premium, OR

105%of all Premiums paid as on death,WHICHEVER IS HIGHER.

On Survival :

On survival Basic Sum-Assured + Reversionary Bonus+ Final Additional Bonus. Check on Maturity Calculator

Surrendered Value :

The Policy can be surrendered at any time during the policy term provided at least three full years premiums have been paid.

Loan :

Loan Facillity is available under this plan, after payment of premiums for at least 3 full years.

Income Tax Benefit :

• Premium paid under this plan is eligible for TAX rebate under section 80c.

• Maturity under this plan is free under sec 10(10D).

LETS SEE EXAMPLE of Jeevan Labh:

Suppose Mr X age 35 yrs old taking this policy for 25 yrs term for 10 lac risk cover.Premium will be 48k with service tax till 16 years remaining 9 yrs ,one has not to pay any premium. At maturity he will get Arround 27lac as maturity.

Age :35 Term :25P.P.T. :16

SA:1000000 D.A.B. : 1000000

Premium With TAX 4.5% :Yearly : 48333 (46252 + 2081)Halfly : 24414 (23363 + 1051)Quarterly : 12331 (11800 + 531)Monthly(ECS) : 4110 (3933 + 177)

Total Approximate Paid Premium : 757728

Approximate Return at Maturity Time

Approximate Return : 2700000

What is the bonus rate in New Jeevan Labh?

As we know that there is two bonus rate is applicable in New jeevan Labh Policy.

1) Bonus

2) Final Additional Bonus

Both bonuses are depends on the term of Policy and Sum Assured of policy.

Rates of bonus on New Jeevan Labh plan 936 in year 2020 are as below:

Rates of bonus on New Jeevan Labh plan 936 in year 2020 are as below: