a) life insurance premium paid in order to effect or to keep in force an insurance on the life of assessee or the life of the spouse or any child of assessee and in the case of h u f, premium paid on the life of any member thereof under an insurance policy (other than a contract for a deferred annuity), issued on or before the 31st day of March 2012 shall be eligible for deduction only to the extent of 20% of the actual capital sum assured or actual premium paid whichever is less.

b) life insurance premium paid in order to effect or to keep in force an insurance of the life of the assessee or on the life of the spouse or any child of assessee and in the case of HUL , premium paid on the life of any member thereof , under an insurance policy( other than a contract for and deferred annuity) , issued on or after the 1st day of April 2012 shall be eligible for deduction only to the extent of 10% of the actual capital sum assured aur actual premium paid whichever is less.

Where the policy, issued on or after the first day of april, 2013, is for insurance on life of any person .

Who is—

i) a person with disability aur a person with severe disability as referred to in section 80u, or

ii) suffering from disease or ailment as a specified in under section 80dd b, deduction under the section is allowed only to the extent of 15% of the actual capital sum assured or actual premium paid whichever is less.

c) contribution to deferred annuity plans in order to effect or to keep in force a contract for deferred annuity, on his own life or the life of his spouse or any child of such individual is eligible for deduction, provided such contract does not contain a provision to exercise an option by the insured to receive cash payment in lieu of the payment of annuity.

d) contribution to annuity plans lIC new Jeevan Dhara and and new Jeevan Akshay is eligible for deduction.NOTE: The aggregate amount of deduction under section 80c, 80ccc and 80ccd (1) shall not not in any case exceed 150000 rupees.

PROOF OF INCOME

The following documents can be considered as proof of income:

- Salary Certificate

- Personal Financial Questionnaire

- Chartered Accountant’s Certificate

- Income Tax Returns (ITRs) with computation of income statement of Income Tax Orders

- Audited Company/ Firm Accounts including Profit & Loss Accounts.

Bank’s Statements (Pass Book) - The land revenue records in form of 7/12 extracts certificate from Tahasildar regarding crop pattern indicating crop yield, whenever source of income is shown as agriculture.

- Whenever income from export is indicated in proposal form / I.T. returns/ Computation of income/ CA’s certificate, then income certificate in the form of report under 80 HHC and Form No. 10 CCAC duly completed and attested should be obtained.

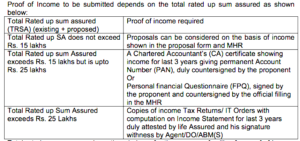

Proof of Income to be submitted depends on the total rated up sum assured as shown below:

Total rated up sum assured mentioned above for the purpose of calling for proof of income will be calculated as under :-

Total rate up sum assured on the life of the proposer

- Total rated up insurance on the lives of all children aged up to 25 (financed by parents)

- Total rated up insurance on the life of wife (financed by husband up to a maximum of Rs. 30 lacs)/ total rated up insurance on the life of husband (proposed and financed by wife) +Total rated up credit given to sons and unmarried daughters aged more than 25 years. In the case of proposals on the lives of children aged upto 25, proof of income of the personal (father or mother) funding the insurance is to be called for.

The proof of income will depend on the total rated up sum assured calculated as above. In the case of proposals on the lives of married women on the basis of husband’s income, proof of income of the husband is to be called for. The proof of income will depend on the total rated up sum assured calculated as above. Income shown in the Income tax returns: Income Tax Returns (ITRs) show only net income.

Therefore, standard deduction if allowed can be added to the total income. If any interest is paid for housing loans and if it is claimed as a deduction against income from housing property, it can be added back to the total income. If income exempted from income tax (e.g. dividend income, export income, interest on tax- free bonds, agricultural income etc) is either mentioned in the ITRs or in the computation of income statement attached with ITRs, then separate proof of such income need not be called for.

However, if such exempted income is not mentioned it ITRs or computation of income Statement, Proof of the income should be called for.

Share of profit from Partnership firms:

Copies of partnership deed and ITRs/ audited accounts for last three years are to be called for, it is to be ensured that the partnership deed is still in force and the partners are actually receiving their share of profit.