1. Jeevan shanti policy can be surrendered at any time after three months from the Date of issuance of policy or after expiry of the free-look period, whichever is later.

1. Jeevan shanti policy can be surrendered at any time after three months from the Date of issuance of policy or after expiry of the free-look period, whichever is later.

2. Surrender is allowed only under the following annuity options:

a) Immediate annuity–

Option F: Immediate Annuity for life with return of Purchase Price.

Option J: Joint Life Immediate Annuity for life with a provision for 100% of the annuity payable as

long as one of the Annuitant survives and return of Purchase Price on death of last survivor.

b) Deferred annuity–

Option 1: Deferred annuity for Single life.

Option 2: Deferred annuity for Joint life.

3. On payment of the surrender value all other benefits payable will cease.

Procedure for Determining Surrender Value:

a. Surrender During deferment period under Deferred Annuity:

SV = F3 x (F1 x Equivalent annuity amount payable for yearly mode + F2 x 110% of Purchase Price)

Where:

F1 is Annuity Factor applicable at age lbd on the date of Vesting.

F2 is the Risk Factor applicable for age lbd on the date of Vesting.

F3 is the Factor applicable for outstanding deferment period in complete full years as at date of

surrender.

For Example: if the policy with deferment Period 20 years is surrendered during 20th year of policy, then outstanding period will be Zero.

In case of Joint life policies factors F1 and F2 shall depend on the age lbd of younger annuitant.

Example:

Age at Entry (lbd): Primary Annuitant – 45 Years, Secondary Annuitant – 35 years.

Purchase Price – 10,00,000, Deferment Period – 20 years, Annuity Mode – Yearly,

Calculate Surrender Value payable during 4th

year.

Age lbd of Younger age at Vesting = 35 + 20 = 55 years

Annuity rate Payable p.a. for 10 lacs Purchase Price under Joint Life = 225.10 + 2.10 = 227.20

Annuity Payable Per annum = 10,00,000 x 227.20/1000 = 2,27,200

Outstanding Deferment Period = 20 – 4 = 16 years.

Factor F1 at Age 55 lbd = 9.4760

Factor F2 at Age 55 lbd = 0.1306

Factor F3 for Outstanding Deferment Period of 16 years = 23.94%

Surrender Value = F3 x (F1 x Annual Annuity Payable + F2 x 110% of Purchase Price)

= 23.94/100 x (9.4760 x 2,27,200 + 0.1306 x 11,00,000)

= 0.2394 x (21,52,947 + 1,43,660)

= 0.2394 x (22, 96,607) = 5,49,807

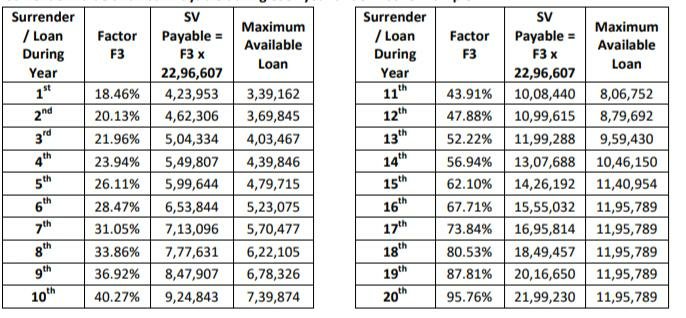

Surrender Value and Loan Payable during each year under Above Example:

b) Surrender after deferment period under Deferred Annuity and under Immediate Annuity:

Surrender Value =

(F1 x Equivalent annuity amount payable for yearly mode + F2 x 110% of Purchase Price) – Annuity

installments paid under the policy during the policy year of surrender up to date of surrender.

Where:

F1 is Annuity Factor applicable for age lbd on the date of surrender.

F2 is the Risk Factor applicable for age lbd on the date of surrender.

In case of Joint life policies factors F1 and F2 shall depend on the age lbd of younger annuitant.

Example:

Age at Entry (lbd): Single/Primary Annuitant – 45 Years, Secondary Annuitant – 35 years.

Purchase Price – 10,00,000, Deferment Period – 20 years, Annuity Mode – Yearly,

Calculate Surrender Value after 3 years (During 4th year after Vesting):

a) Under Option F of Immediate Annuity and

b) Option 2 of Deferred Annuity

a) Under Option F of Immediate Annuity:

Age lbd of Annuitant on the date of Surrender = 45 + 3 = 48

Annuity Rate under option F for 10 Lacs Purchase Price Payable yearly = 63.30 + 2.10 = 65.40

Annuity payable p.a = 10,00,000 x 65.40 /1000 = 65400

Factor F1 for Age lbd 48 years = 10.0515

Factor F2 for Age lbd 48 years = 0.0828

SV = (F1 x Equivalent annuity amount payable for yearly mode + F2 x 110% of Purchase Price) –

Annuity installments paid under the policy during the policy year of surrender up to date of surrender.

SV = (10.0515 x 65400 + 0.0828 x 11,00,000) – Nil ( As Annuity mode is yearly).

= 6,57,368 + 91,080 = 7,48,448