Joint Life Insurance Policies: Benefits, Drawbacks, and How to Choose the Right Coverage for You and Your Partner

Introduction:

Joint life insurance policies are a type of life insurance that provides coverage for two individuals, typically spouses or partners.

In a joint life insurance policy, both individuals are covered under a single policy, and the death benefit is paid out when one or both of the insured individuals pass away. In this article, we will explore the basics of joint life insurance policies, their benefits and drawbacks, and factors to consider when choosing the right policy for you and your partner.

Individual vs. Joint Life Insurance Policies:

Individual life insurance policies provide coverage for a single person, while joint life insurance policies provide coverage for two people. There are several differences between the two types of policies that should be considered when choosing the right coverage for you and your partner.

One key difference is the cost of the policy. Joint life insurance policies are generally more affordable than individual policies because they cover two people under a single policy.

However, it’s important to note that the death benefit is typically paid out only once, either when one or both of the insured individuals pass away.

In contrast, individual policies provide a death benefit for each individual covered under the policy.

Another difference is the flexibility of the policy. With an individual policy, each person can choose the amount of coverage they need based on their individual circumstances.

With a joint policy, the coverage amount is typically shared between the two individuals, which may not provide adequate coverage for each person’s needs.

Types of Joint Life Insurance Policies:

There are two main types of joint life insurance policies: first-to-die and second-to-die.

First-to-Die Policies: In a first-to-die policy, the death benefit is paid out when the first insured individual passes away.

This type of policy is typically used to provide financial protection for a spouse or partner, as the death benefit can help cover expenses such as a mortgage or other debts.

Second-to-Die Policies: In a second-to-die policy, the death benefit is paid out when both insured individuals pass away.

This type of policy is typically used for estate planning purposes, as the death benefit can help cover estate taxes or other expenses related to the passing of both individuals.

Benefits of Joint Life Insurance Policies:

- Cost Savings: Joint life insurance policies are typically more affordable than individual policies, as the cost is shared between the two insured individuals.

- Simplicity: Joint life insurance policies are generally simpler and easier to manage than multiple individual policies.

- Estate Planning: Second-to-die joint life insurance policies can be useful for estate planning purposes, as the death benefit can help cover estate taxes or other expenses.

- Shared Coverage: Joint life insurance policies provide coverage for both individuals under a single policy, which can be beneficial for couples who share financial responsibilities.

Drawbacks of Joint Life Insurance Policies:

- Shared Coverage: While shared coverage can be beneficial, it may not provide adequate coverage for each individual’s needs.

- Death Benefit: Joint life insurance policies typically pay out the death benefit only once, either when one or both of the insured individuals pass away.

- Complexity: While joint life insurance policies can be simpler to manage than multiple individual policies, they may be more complex to understand and compare.

Considerations for Choosing a Joint Life Insurance Policy:

- Coverage Amount: When choosing a joint life insurance policy, it’s important to consider the coverage amount and whether it will provide adequate financial protection for both individuals.

- Type of Policy: First-to-die policies may be more suitable for couples who have a mortgage or other debts that would need to be covered in the event of one partner’s death, while second-to-die policies may be more suitable for couples who are planning for estate taxes or other expenses related to the passing of both partners.

Policy Features of Joint Life Insurance:

When comparing joint life insurance policies, it’s important to consider the features of each policy, such as the length of coverage, premium amounts, and any additional benefits or riders.

Age and Health: The age and health of both individuals should also be considered when choosing a joint life insurance policy.

The premiums for the policy may be higher if one or both individuals have pre-existing health conditions or are older.

Financial Goals: It’s important to consider your overall financial goals when choosing a joint life insurance policy. The policy should provide adequate coverage to protect your financial future, while also fitting within your budget and long-term financial plans.

In Conclusion:

Joint life insurance policies can be a cost-effective and simple way to provide financial protection for couples. However, it’s important to consider the differences between joint and individual policies, the types of joint policies available, and the factors to consider when choosing the right coverage for you and your partner. By carefully considering your financial goals, coverage needs, and policy options, you can choose the best joint life insurance policy to provide financial security for your loved ones.

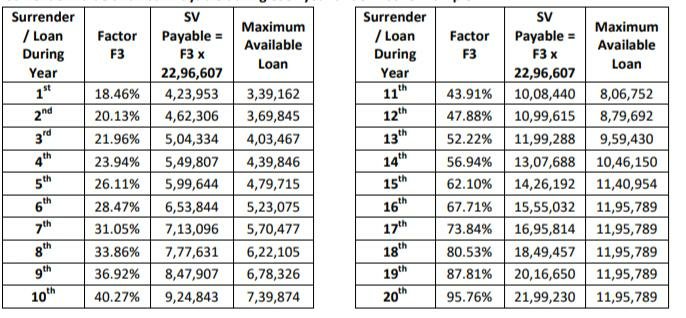

1. Jeevan shanti policy can be surrendered at any time after three months from the Date of issuance of policy or after expiry of the free-look period, whichever is later.

1. Jeevan shanti policy can be surrendered at any time after three months from the Date of issuance of policy or after expiry of the free-look period, whichever is later.