Life insurance is a contract between an insurer and a policyholder, where the insurer promises to pay a designated beneficiary a sum of money upon the death of the policyholder.

There are various types of life insurance policies, and term life insurance is one of them. In this article, we will explore the basics of term life insurance, its benefits, drawbacks, and some considerations to keep in mind while choosing a term life insurance policy.

What is Term Life Insurance?

Term life insurance is a type of life insurance policy that provides coverage for a fixed period of time or a “term.” It is designed to provide financial protection to the policyholder’s beneficiaries in the event of the policyholder’s death during the term. Unlike whole life insurance, which provides lifetime coverage and has a cash value component, term life insurance does not have a cash value and is solely focused on providing death benefit coverage.

Term life insurance policies can typically be purchased for terms ranging from one year to 35 years.

Once the term of the policy is over, the coverage ceases, and the policyholder has the option to renew the policy or let it expire.

Benefits of Term Life Insurance:

Affordable Premiums: Term life insurance is generally more affordable than other types of life insurance policies, such as whole life insurance. This is because term life insurance policies only provide coverage for a specified period and do not have a cash value component.

Flexibility: Term life insurance policies can be tailored to meet the policyholder’s needs, such as the length of the term and the amount of coverage.

Simple: Term life insurance policies are relatively simple and straightforward, making them easy to understand.

Death Benefit: Term life insurance policies provide a death benefit that can help provide financial support to the policyholder’s beneficiaries in the event of the policyholder’s death.

Drawbacks of Term Life Insurance:

No Cash Value: Unlike other types of life insurance policies, such as whole life insurance, term life insurance policies do not accumulate cash value over time.

Limited Coverage: Term life insurance policies only provide coverage for a specified period, which means that if the policyholder outlives the term, the policy will expire, and no death benefit will be paid out.

Renewal: If the policyholder decides to renew the policy after the initial term, the premiums may increase, which can make the policy more expensive over time.

Considerations for Choosing a Term Life Insurance Policy:

Length of the Term: When choosing a term life insurance policy, it’s important to consider the length of the term. The length of the term should be long enough to provide adequate coverage for the policyholder’s beneficiaries.

Coverage Amount: The coverage amount should be sufficient to provide financial support to the policyholder’s beneficiaries in the event of the policyholder’s death. It’s important to consider the policyholder’s income, debts, and other financial obligations when determining the coverage amount.

Premiums: The premiums for the policy should be affordable and fit within the policyholder’s budget.

Renewal Options: If the policyholder wants to renew the policy after the initial term, it’s important to consider the renewal options and any associated costs.

Conclusion:

Term life insurance is a popular and affordable option for individuals who want to provide financial protection to their beneficiaries in the event of their death. While term life insurance policies have some drawbacks, such as no cash value and limited coverage, they offer many benefits, such as affordable premiums, flexibility, and a death benefit.

When choosing a term life insurance policy, it’s important to consider the length of the term, coverage amount, premiums, and renewal options to ensure that the policy meets the policyholder’s needs and budget.

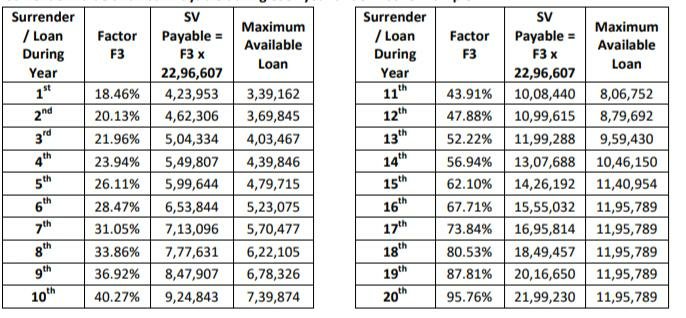

1. Jeevan shanti policy can be surrendered at any time after three months from the Date of issuance of policy or after expiry of the free-look period, whichever is later.

1. Jeevan shanti policy can be surrendered at any time after three months from the Date of issuance of policy or after expiry of the free-look period, whichever is later.