If you don’t want to continue LIC policy for any reason then LIC gives you an option to surrender your Policy. There are Lock in period for 3 years in Endowment Plan and 5 years for ULIP plan. LIC policy is not allowed in LOCK in period. It does not matter of policy term but it is clear that delay in surrender gives you better amount. Normally LIC agents in Mumbai are doing all this procedure for surrender of LIC policies.

Where can you surrender your LIC policy

ü LIC parent Branch: Where you have taken your policy, you may go there and do all procedure.

ü LIC Customer Zone: LIC has opened several Customer Zone to help its customer.Here one can get any service related to LIC policies irespestive of parent branch. It is compulsory that Customer has to visit by own along with ID card.You can find Customer Zone in your locality with the help of internet.

ü LIC agent: Just do a call to LIC agent,he will do all documentation of behalf of you.

Documents Require To surrender LIC Policy

Ø Original Policy Paper (Bond Paper)

Ø Surrender Form (No.5074)Surrender Value(Form No.5704)

Here and take the printout

Ø Your Bank cancelled cheque (your name should be printed on cheque)

If Your Name is not printed on cheque or you don’t have Cheque Book then

Submit bank passbook photocopy.

Ø NEFT form :Fill all bank details , so that amount will go directly to you.

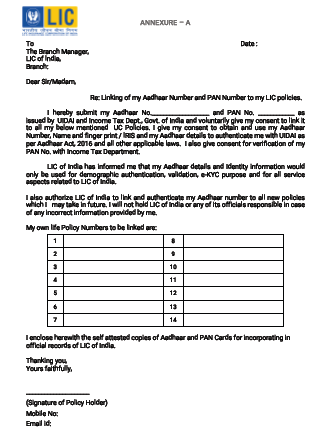

Ø Aaadhar Card and PAN card self attested zerox copy

Ø One questionnaire form also should be fill in LIC office.

How to Calculate Surrender Amount?

The exact value will be conveyed to you through servicing branch or you can also collect it through SMS/LIC customer care.but you can also calculate it by own.

{(Total Premium Paid in years/total premium Payable years)X Sum Assured } + Accrued Bonus } X Surrender Factor

Suppose Mr A has take a policy of rs 30 Lac for 30 years terms. Now Having paid for 10 years , Mr A wants to surrender it.

{(10/30) X 30 lac} + Bonus } LIC surrender Factor}

Note:Once you submit the all necessary documents, then wait for 5-10 days they transfer the fund to your bank account.

If you plan to surrender your endowment policy, bear in mind all the money you have paid that you may never get back.

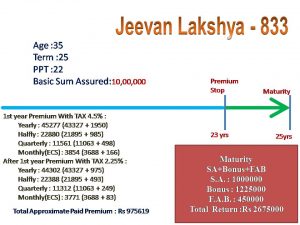

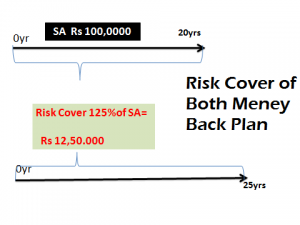

Policy term= 20 years

Policy term= 20 years

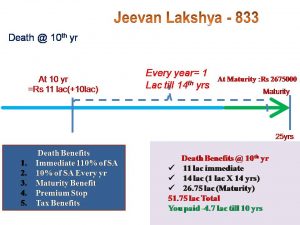

What is Sum Assured on Death?

What is Sum Assured on Death?