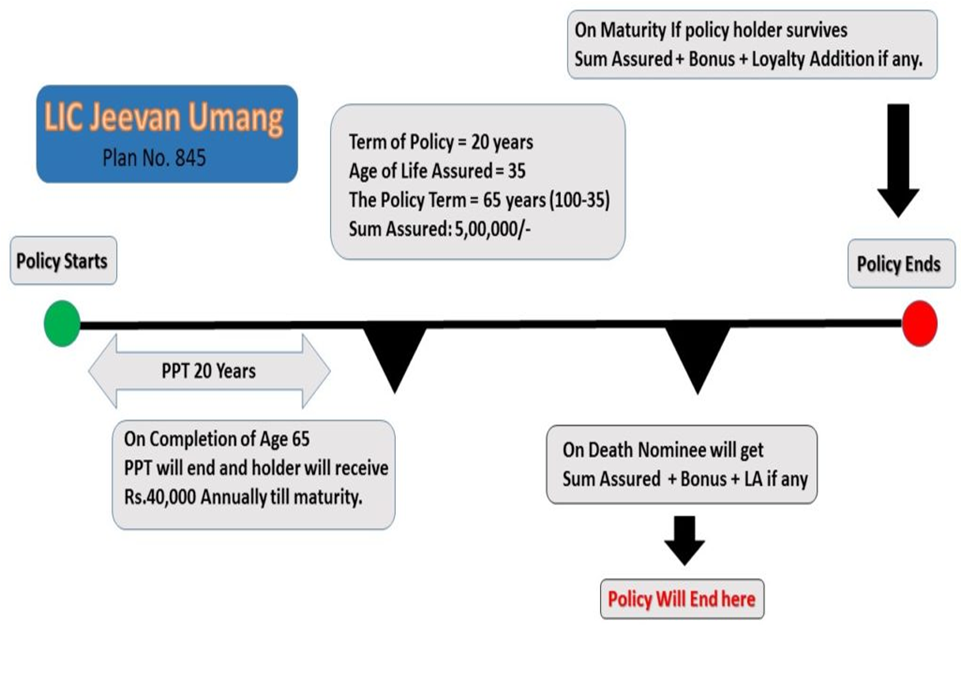

LIC Jeevan Umang Plan Number 845 is limited Premium ,non linked(not market linked) with profit plan .

Plan provides annual survival tax free returns from the end of Premium Payable term to till 100 years of policy holder along with risk cover. Jeevan Umang is a solution regular income with complete protection of family.

Umang consists all three benefits that is

- Survival benefits,

- Death cover and

- Maturity benefits

Survival benefits

Survival Benefit

From the end of your premium payable term you will get 8% of Sum assured amount till your 100yrs.

As for example ,if you take a Jeevan umang policy of 10 lac for 20 yrs then after 20 yrs you will get 8% of 10 lac (Rs 80,000) till your 100 years.

Death cover

If death occurs between the date of policy taken to till 100 yrs of policy holder ,then

Sum assure + Vested Bonus + Final addition bonus will be paid

Maturity Benefit

At the age of 100 yrs

Sum assure + Vested Bonus + Final addition bonus will be paid

Policy term= 20 years

Policy term= 20 years

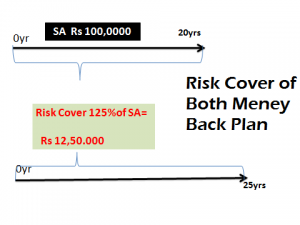

What is Sum Assured on Death?

What is Sum Assured on Death?