LIC (Life Insurance Corporation of India) is a state-owned insurance company that offers a variety of insurance products, including life insurance policies. If you are interested in purchasing an insurance policy from LIC, there are a few options available to you:

Visit the LIC website (www.licindia.in) and explore the different insurance products that are available. You can also use the website to see premiums, download policy documents, and more.

Contact a local LIC branch or agent. You can find the contact information for your nearest branch or agent by visiting the LIC website and using the “Branch Locator” tool.

Note : All LIC plans are not available for online sale yet.

You can also purchase an LIC policy online, through the LIC website or through a licensed insurance broker or intermediary. Some policies can be purchased and activated entirely online, while others may require you to complete additional steps, such as submitting physical documents or undergoing a medical examination.

I hope this information is helpful! Let me know if you have any other questions. my email address is aivinash777singh@gmail.com !

Here are few more details about purchasing an insurance policy from LIC.

Before purchasing a policy, it is important to carefully consider your insurance needs and choose a policy that is suitable for you. You may want to consider factors such as your age, health, financial situation, and the type and amount of coverage that you need.

When purchasing a policy, you will need to provide personal and financial information, such as your name, address, date of birth, and income. You may also be required to undergo a medical examination, depending on the type of policy you are purchasing and your age.

Once you have selected a policy, you will need to pay the premiums in order to maintain your coverage. Premiums can typically be paid on a monthly, quarterly, or annual basis, and can be paid online or at a local branch.

It is important to keep your policy documents safe and easily accessible. You may need to refer to them in the event of a claim or to make changes to your policy. You can also check the status of your policy online, through the LIC website or mobile app.

I hope this additional information is helpful! Let me know if you have any other questions.

Note :Having an LIC agent will be more helpful rather go for Online .

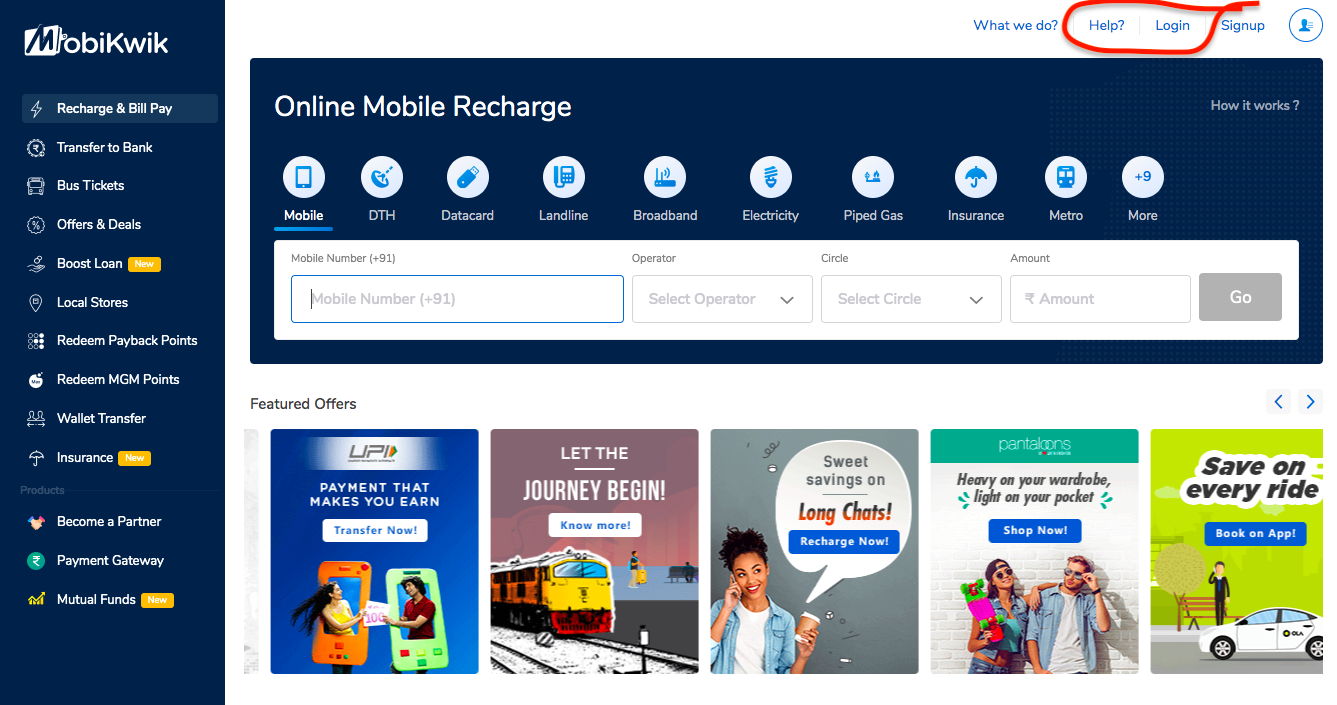

Introduction about Mobikwik

Introduction about Mobikwik

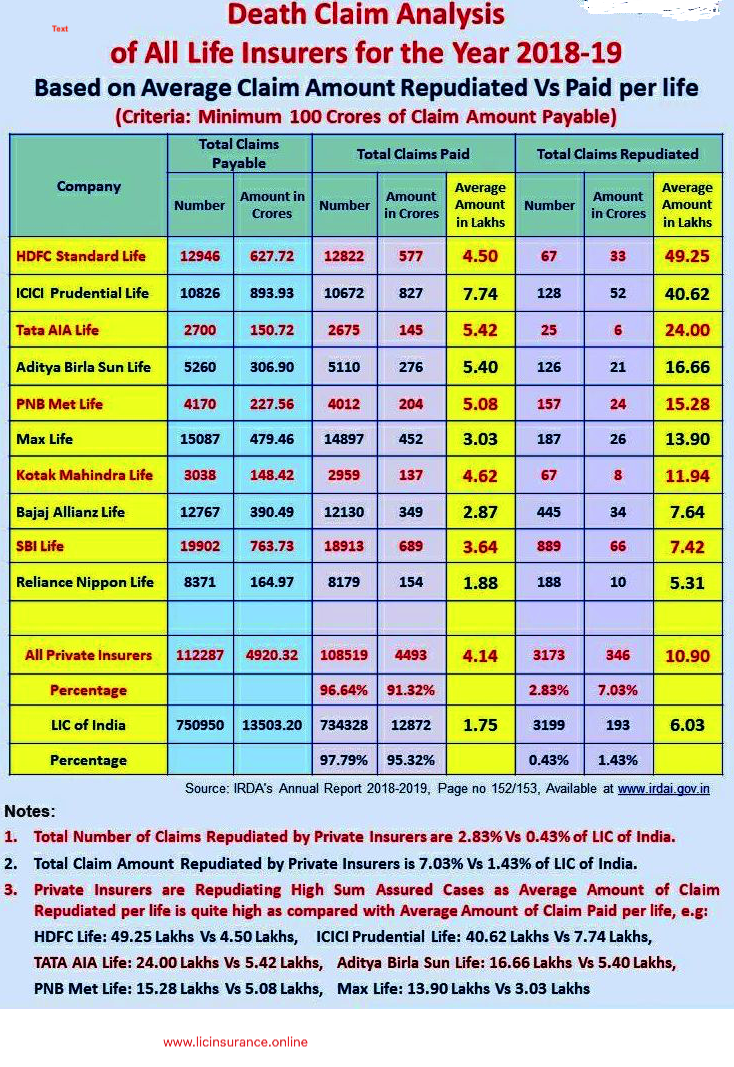

REPUDIATION:

REPUDIATION: HDFC: 49.25 Lacs

HDFC: 49.25 Lacs