Introduction about Mobikwik

Introduction about Mobikwik

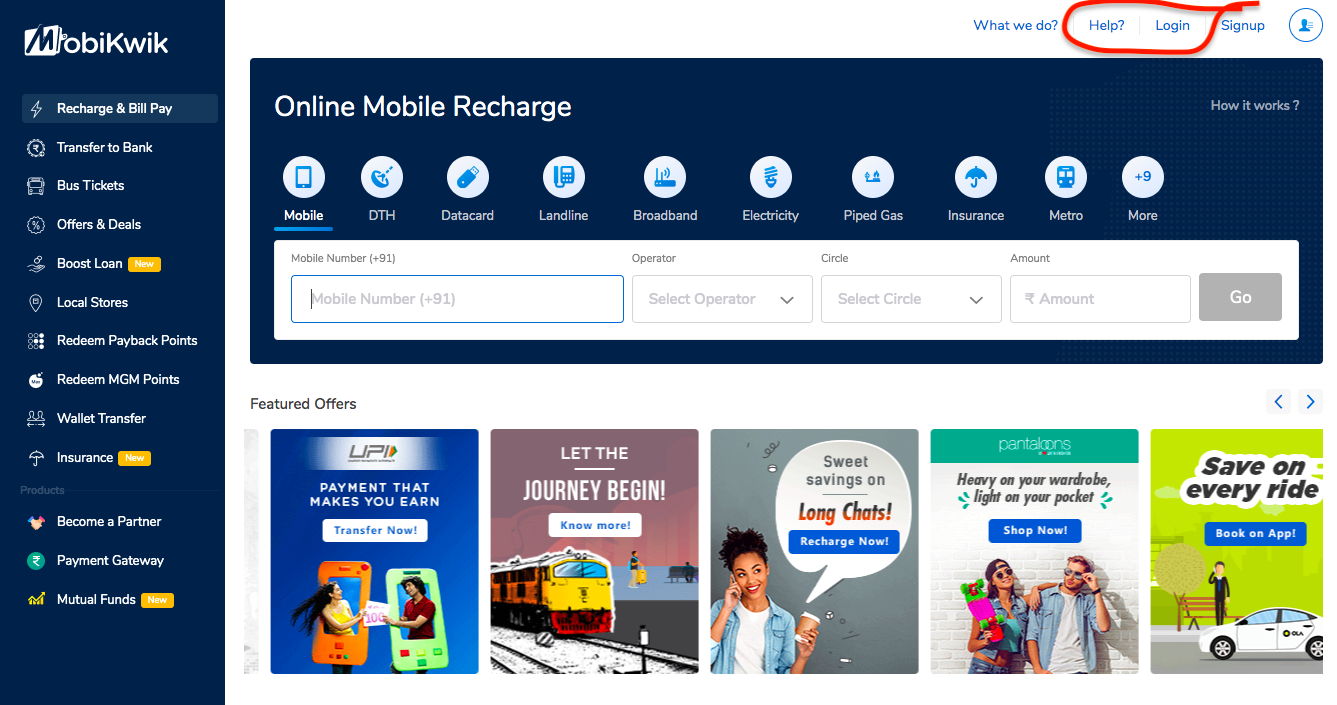

MobiKwik is one of the India based e-commerce payment systems which was founded in 2009, by Bipin Preet Singh and his wife – Upasana Taku. The company was started with an initial seed capital of $250 thousand. It provides mobile phone-based payment system and acts as a digital wallet. Users can add money to an online wallet which can be used for making online payments. It launched an e-wallet system in the year 2012 which helped its customers to deposit money online which could be used for bill payments and other features.

MobiKwik app is available on both iOS and Android-based devices. The Reserve Bank of India authorized the company’s use of MobiKwik wallet in 2013 and beginning from May 2016, the digital wallet started providing small loans to consumers as a part of its services.The company started its MobiKwik Lite mobile app during November 2016 which is designed for users of older 2G mobile networks and for those users who stay at a place which has poor internet connectivity. As on November 2016, the firm reported that close to 1.5 million merchants are using their services, with the user base touching close to 55 million customers.

During the initial stages after inception, the service was provided through a website with a closed wallet facility but over the last few years, the firm has successfully extended its services to mobile apps as well. In the beginning, MobiKwik partnered with online merchants and made their wallet available as a payment option on e-commerce sites. MobiKwik is backed by several investment groups which include American Express, MediaTek, Sequoia Capital, Tree Line Asia, Cisco Investments, GMO Payment Gateway, Bajaj Finance and Net1.

How to Download MobiKwik?

If the user is using an Android-based phone then follow the below-mentioned steps to download MobiKwik.

First, go to the Google Play Store Search for MobiKwik app Download the app Install it

Note: If the users have an Apple phone, then download the MobiKwik app from the Apple app store.

How to Use the MobiKwik App?

First Download the app in your mobile phone from the Google Play/ Apple app store and launch it Now open the app and enter your registered mobile number Click on ‘Send OTP’ option after this. You will receive an OTP. Now enter the received OTP for verification purpose Finally, the user gets successfully registered on MobiKwik app.

How to Pay Grocery Bills using MobiKwik Wallet?

- Step 1: First, log in to the MobiKwik App

- Step 2: Inform the store operator that you are paying using the MobiKwik Wallet

- Step 3: Share your mobile number with the store operator

- Step 4: You will receive an OTP on your registered mobile number, share the same with store operator

How to Transfer Money using MobiKwik?

First login to the MobiKwik app Now go to the home screen and click on ‘Transfer Money’ Proceed further and click on ‘Wallet to Bank Transfer’ Key in the bank details of the beneficiary or payee, verify the details once again and click on ‘Send Money’ option You will receive an OTP on your registered mobile number Now verify the OTP and submit the same The money will be sent to the respective account .

Procedure for Prepaid Currency Recharge using MobiKwik

- Step 1: First open the MobiKwik app

- Step 2: Click on the ‘Prepaid’ option and enter your mobile amount

- Step 3: Now enter the recharge amount which you prefer to recharge for

- Step 4: Proceed to click on ‘Recharge’ option.

How to Add Money to MobiKwik Payment App?

First login to the MobiKwik app Now click on the ‘Add Money’ option Enter the amount you prefer to add and click on the ‘continue’ option The user will be redirected to the payment page, wherein one can add money through any of the three payment options be it – Debit or credit card, cash deposit or pick up or a debit or credit card. Choose an appropriate option as per your convenience. Enter the payment details and click on ‘Pay Now’ option. (enter the promo code, if you receive any) Make payments by entering either OTP or password. Now, the newly added amount will soon reflect in your MobiKwik wallet

Personal Loans on MobiKwik

MobiKwik users can avail instant personal loans online as the payment wallet offers instant personal loan, the first of its kind in India. The unique feature of it is, the loan can be availed without pledging any security. All that the user has to provide only a few basic details to secure the instant personal loan online. Benefits of Instant Personal Loan with MobiKwik Quick, simple process Collateral is not required Minimal documentation Bank transfer option available

How to Apply for MobiKwik Loan?

First login to the MobiKwik app Select the wallet Click on the ‘Balance Details’ Proceed further and click on the ‘Boost’ option Now click on ‘Let’s Start’ on the corresponding screen Enter your PAN and Aadhaar number respectively Proceed further and Agree to the terms and conditions and click on ‘View Loan Details’ Thereafter, the user has to follow the instructions mentioned in the corresponding screens Once the loan is approved, the said amount will be credited into the MobiKwik Wallet.

MobiKwik Online Insurance

With a first of its kind, the e-wallet firm MobiKwik is offering MobiKwik Online Insurance cover to its users starting at just Rs 20.

The user can purchase the life insurance, cyber fraud insurance, personal accidental insurance instantly with a minimum cost and at maximum transparency.

The accidental insurance comes in with a cover of Rs 1,00,000 a year at a premium amount of Rs 20 per month.

Premium Amount Customers can pick from any of the premium amounts which assures a specific sum Sum assured of Rs 1 lakh for a premium amount of Rs 20 per month Sum assured of Rs 1.5 lakh for a premium amount of Rs 30 per month Sum assured of Rs 2 lakh for a premium amount of Rs 40 per month In 2019, MobiKwik partnered with Max Bupa to offer bite-sized health insurance products. They are aimed mainly towards those people who find it difficult to buy an insurance cover for medical emergencies owing to high premium costs.