Life Insurance Corporation (LIC) of India is going start sending sms to message customer from the March 1, 2019, the policyholders will get automated SMS to update their customers regarding politics payment due, lapsation,revival ,surrender and maturity also.

One will get SMS, Like

“Dear Customer, we inform you that LIC will send Premium Due Intimations and reminders for your Policy Number xxxxxxxx by SMS only, with effect from 01.03.2019.”

If you have not received this SMS, it means your mobile number is not registered with LIC politics.

It is very easy to register your Mobile number with LIC of India,you may call to LIC agent to whom you have purchased politics.

If your agent is not in contact with you then you can go to LIC branch and submit letter to update it.

You may also do it online by visiting www.licindia.in/Customer-Services

or by calling 24×7 helpline number 022-68276827.

The corporation will send about 65 such messages, apart from reminder for premium payment, in case of a policy gets lapsed, revived or foreclosed, a policy bond is dispatched,bonus or loyalty is added, NEFT or NACH mandate is registered or rejected, maturity amount becomes due or paid and even greeting message on New year etc.

LIC CUSTOMER CARE

Earlier you had to either depend to your LIC AGENT or you have to call customer care in office hour for the sake of finding information about your LIC plan.

Now it’s a great initiative that Customer care help available for round the clock.

24×7 helpline number 022-68276827.

LIC Customer Portal:

If your tecno sevy and want to know every time regarding bonus accrued , surrender value,loan available, premium paid certificate ,to pay your premium online etc, you can enroll your LIC POLITICS in customer portal what you may find on LIC website.

3 things is necessary to enroll your policy

- Your Premium amount without service tax.

- Your date of birth

- Your LIC POLICY number

LIC CUSTOMER ZONES:

Thare are still few services which is directly related to parent branch. Parent branch are those ,from whare you brought your politics. If you see you original LIC bond paper you can easily find LIC branch number. Through such branch number you can find address. There you must have to visit for few services like Nominee change,revival of your politics etc.

You might find uncomfortable to visit there ,as if you have changed your city etc.

Now LIC has established customer zone which is near you and you can get any kind of services there without visiting parent branch.

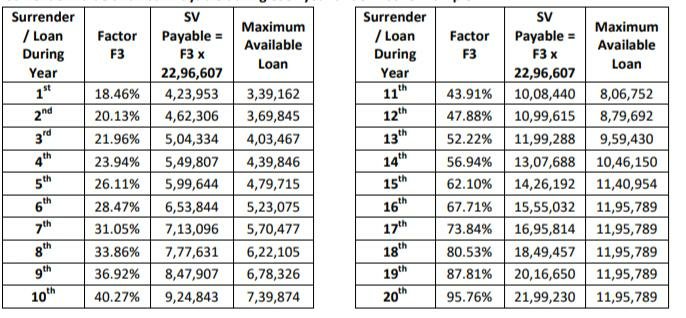

1. Jeevan shanti policy can be surrendered at any time after three months from the Date of issuance of policy or after expiry of the free-look period, whichever is later.

1. Jeevan shanti policy can be surrendered at any time after three months from the Date of issuance of policy or after expiry of the free-look period, whichever is later.