Let us do a fact check on the resent history of IPOs of Government companies (PSUs) in India. LIC IPO Plan is the highest burning issue in the country.

There are only 4 country in the world whose population are more than the total number of LIC policies holder. So it has become national issues.

As well as Private companies are making it as marketing tool (LIC is going to privatise).

Basicaly, LIC IPO (Initial Public Offer) Plan is a Government Plan to produce finance directly from market. Presently LIC total asset is around 31 lakh crore when if IPO comes, its total asset would be arround 51 Lakh crores.

Name IPO year Current status

- SBI 1993 PSU

- PNB 2002 PSU

- BOB 1996 PSU

- ONGC 2004 PSU

- GIC 2017 PSU

- New India 2017 PSU

- IRCTC 2019

You can see that Post-liberalisation Govt has come out with IPOs of many Govt companies and they all are still Govt owned companies.

LIC Of India plans to offer a 5% discount to LIC policyholders on LIC IPOs. Employees of the Indian company and policyholders will receive an additional discount on the LIC IPO share price.

Policyholders of the state insurer will also have a reserved stake in the largest public offering in the country along with LIC employees.

LICs DRHP does not provide details on when the

nation’s largest public issuance will go to Dalal Street, the price of the issuance, the discounts that policyholders and

employees will receive, the valuation and the total size of the issuance.

Proceeds from the sale of LIC shares will go to the Government of India and LIC will not receive any funds from the all-OFS IPO as there will be no new share issues.

The IPO is a 100% offer to sell (OFS) from the government, not a new share issue

from insurance giant LIC.

When LIC IPO is going to launch in Market?

The government has submitted to the stock market regulator a draft prospectus for the sale of 5% of its shares in the Indian Life Insurance Corporation (LIC), its shares in the Indian Life Insurance Corporation (LIC), Life Insurance Corporation (LIC). This was stated on Sunday evening by Secretary of State for the Department of Investment and Public Resources

Management (DIPAM) Tuhin Kanta Pandey.

The State Life Insurance Corporation of India (LIC) today, February 13/2022, has filed a

Draft Prospectus (DRHP) of LIC for its Mega Initial Public Offering (IPO) in SEBI.

The Life Insurance Corporation of India (LIC) has submitted a draft of its sales prospectus to capital market regulator SEBI, paving the way for India’s largest initial public offering (IPO).

After LIC’s board of directors approved the IPO on Sunday,(Feb 2022) LIC is ready to submit a draft red herring prospectus (DRHP) for its initial public offering (IPO) to market regulator Sebi in a couple of days.

Paving the way for the country’s largest public offering ever made, the Life Insurance Corporation on Sunday submitted draft documents to capital market regulator SEBI for the government’s sale of 5% of the capital for an estimated Rs 63,000 crore.

LIC plans to sell 316.25 million shares, about 5% of its total share capital base, according to a draft prospectus for the sale of shares by capital market regulator

SEBI.

The country’s insurance company plans to submit a draft IPO prospectus in the last week of January 2022 that will list the embedded value and number of shares for sale, according to people familiar with the matter.

LIC is the largest life insurer in government with a market share of 64.1 percent in terms of premiums, a market share of

66.2 percent in terms of new business premiums, a market share of 74.6 percent in terms of number of individual policies.

Although the draft prospectus of red herrings does not disclose the market value of LIC, by industry standards it would be about 3 times the embedded value of LIC or about Rs 16 million. However, the government did not disclose in the draft prospectus the insurance giant LIC’s market valuation or the discount that would be given to policyholders or LIC employees in the public offering.

Actuarial firm Milliman Advisors LLP India handled the embedded value of state-owned insurance company Life Insurance Corporation, and Deloitte and SBI Caps were appointed as advisors on the pre-IPO deal. LIC insurers are likely to be able to take a stake in India’s largest IPO at reduced rates.

Introduction about Mobikwik

Introduction about Mobikwik

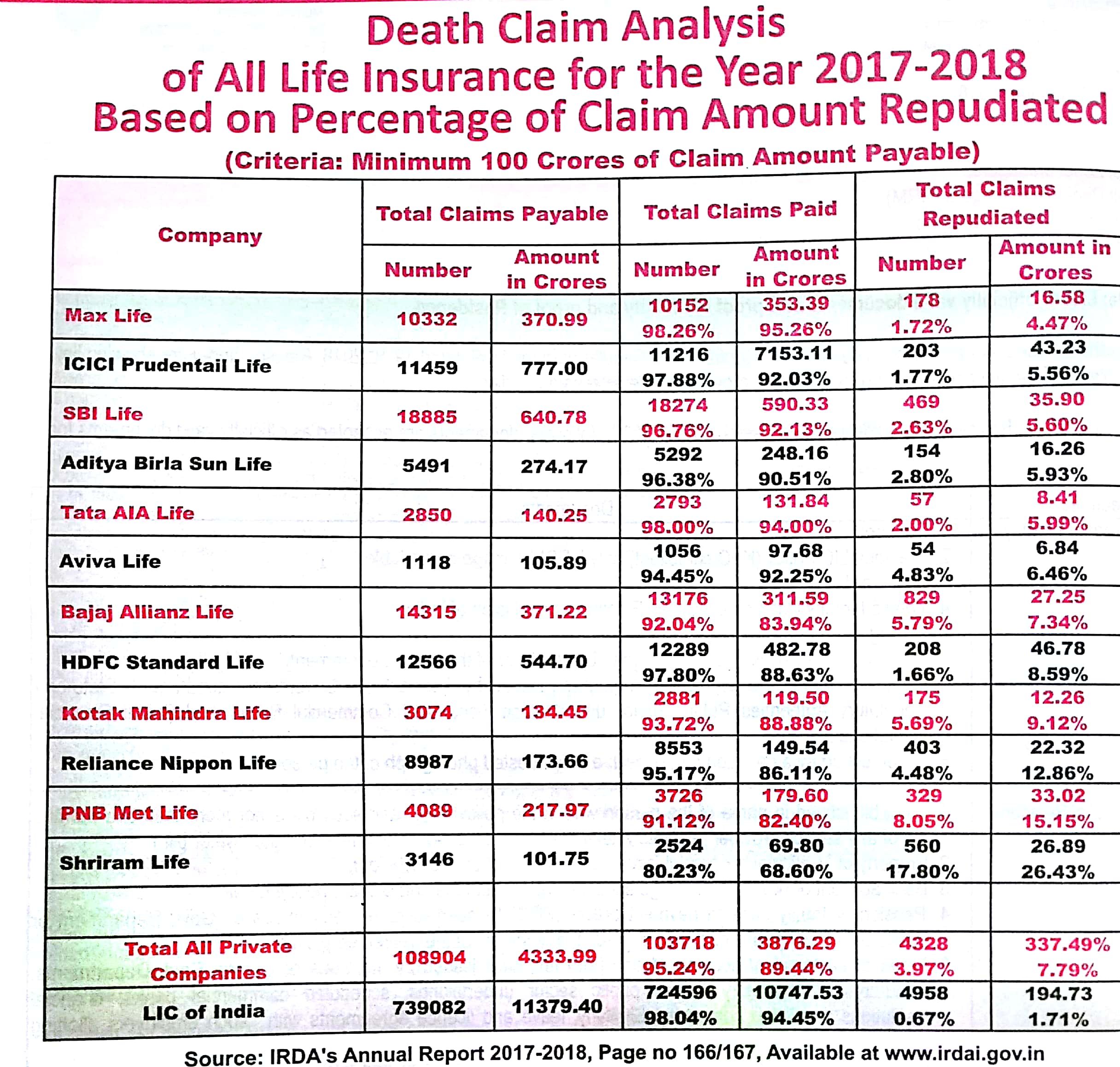

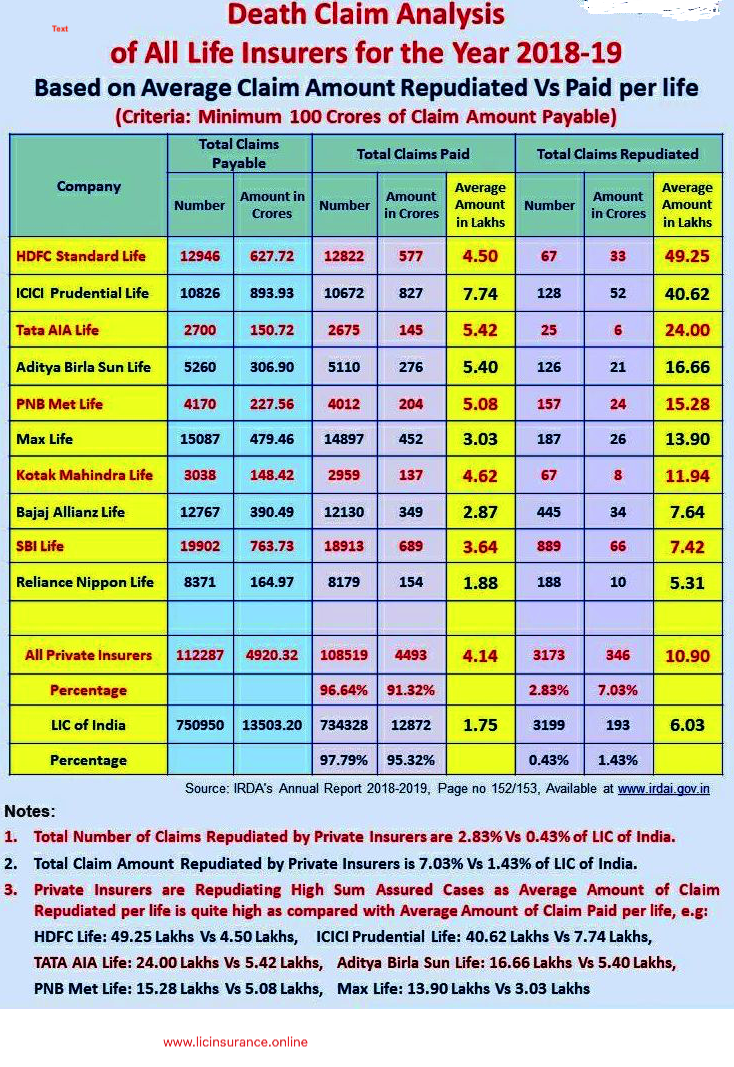

REPUDIATION:

REPUDIATION: HDFC: 49.25 Lacs

HDFC: 49.25 Lacs