LIC launches new lic guaranteed return plan named

New Dhan Varsha plan: Features,Benefits, Maximum Risk cover, premium payment and Maturity benefits

Life Insurance Corporation of India has launched a new life insurance plan New Dhan Varsha (Plan No. 866).Dhan Varsha is a close-ended plan means it is available till 31 March 2023.

Basic feature of LIC’s Dhan Varsha is a non-linked (not connected with the volatility of stock market) , non-participating policy, individual, savings, single premium life insurance plan which offers a combination of protection and savings.

If the life assured unfortunately passes away during the policy term, this plan will give 10 times of premium as cash support for the family.

Benefits under LIC Dhan Varsha Plan

The following are the benefits payable under this Dhan Varsha policy:

A. Maturity Advantage:

The “Basic Sum Assured” and accrued Guaranteed Additions (as described below) will be paid at the time of Maturity.

When a policy is surrendered, the accrued guaranteed additions also include the guaranteed additions in proportion to the months that have already been completed for the Policy Year in question.

B.Death Benefit of LIC Dhan Varsha Plan

There are two option available for Risk cover (Death benefit)

Sum Assured on Death” for both options is defined as under:

Option one : 1.25 times of Tabular Premium for the chosen Basic Sum Assured

Option two: 10 times of Tabular Premium for the chosen Basic Sum Assured

Example of Risk Cover in New Dhan Varsha Plan

In option one 1, If some one pay one time Premium as 10 lac and dies with in the policy term ,his nominee will get 11.25 lac.

In option one 2, If some one pay one time Premium as 10 lac and dies with in the policy term ,his nominee will get 1cr.

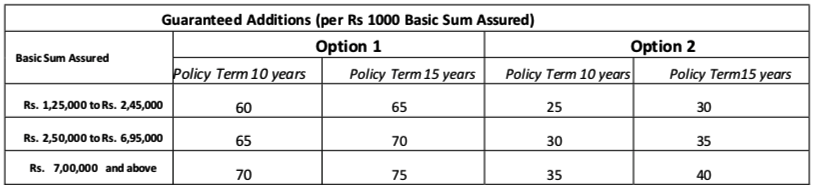

Above chart shows what is Guaranteed Addition in LIC Dhan Varsha Plan

As for Example if MR ABC takes LIC Dhan Varhsha plan in Optiion 1(1.25 times Risk cover)..

Sum assure =10 Lac and Policy term =15 yrs

Guaranteed Addition = (75*1000000*15)/1000 =Rs 11,25000

Total Maturity =Sum Assured + Guaranteed Addition = Rs 10 lac +Rs11.25 Lac =Rs 21.25 lac

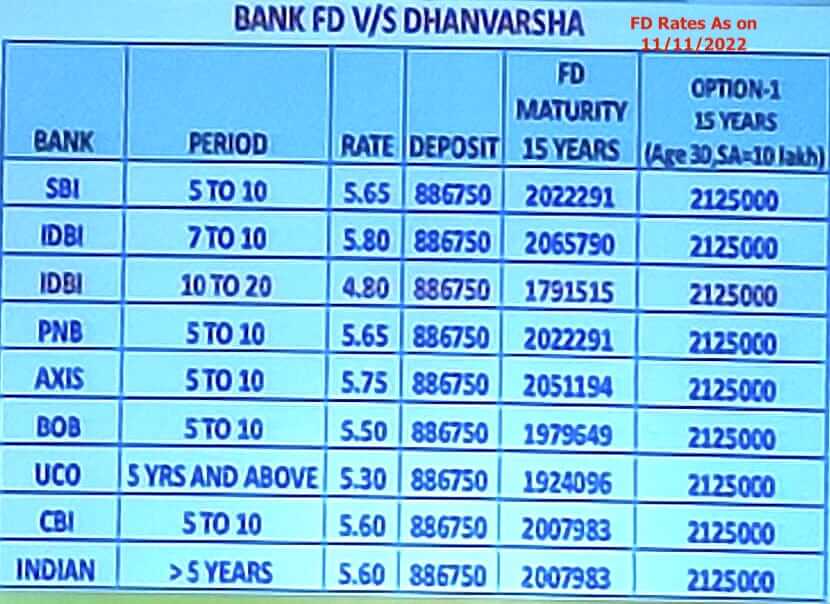

LIC Dhan Varsha Vrs Bank Fix Deposit

- Most of the Indian Bank dont have FDs for 15 yrs .

- Rate of interest on bank FD is decreasing day by day.

- TDS on FD Maturity is also high .

- FD dont have and Risk cover and Tax benefit provision.

Conclusion of this Plan,

Who should Buy LIC dhan Varsha Plan?

- one who want Term Insurance with Maturity.

- one who want TAX benefit with one time investment

- one who want better substitute for Bank FD.

- NRI one who want to save TDS deduction at Maturity of FD.

- Gift to Grand son/daughter