LIC Cancer Cover Plan:

As it shows in its Plans Name, Its a insurance Cover for Cancer disease only.This is a regular premium, non-linked health insurance plan which provides fixed benefits in case life assured is diagnosed with any of the specified Early and/or Major stage cancer during the policy term. A normal Healthy person can take this LIC Cancer Cover plan ,but if unfortunately he is diagnosed with Cancer Disease with in Policy Term then only he/she will be able to get benefit.

BENEFIT OPTIONS:

There is two options while you are getting Cancer cover plan from LIC.

Option I: Level Sum Assured – Basic SA will remain same during the policy term. Suppose you take 10 lac cancer cover Insurance for 30 years ,means you Sum assure is Rs 10 lac and it will be same till 30 yrs.Your Insurance Premium also will be the same.

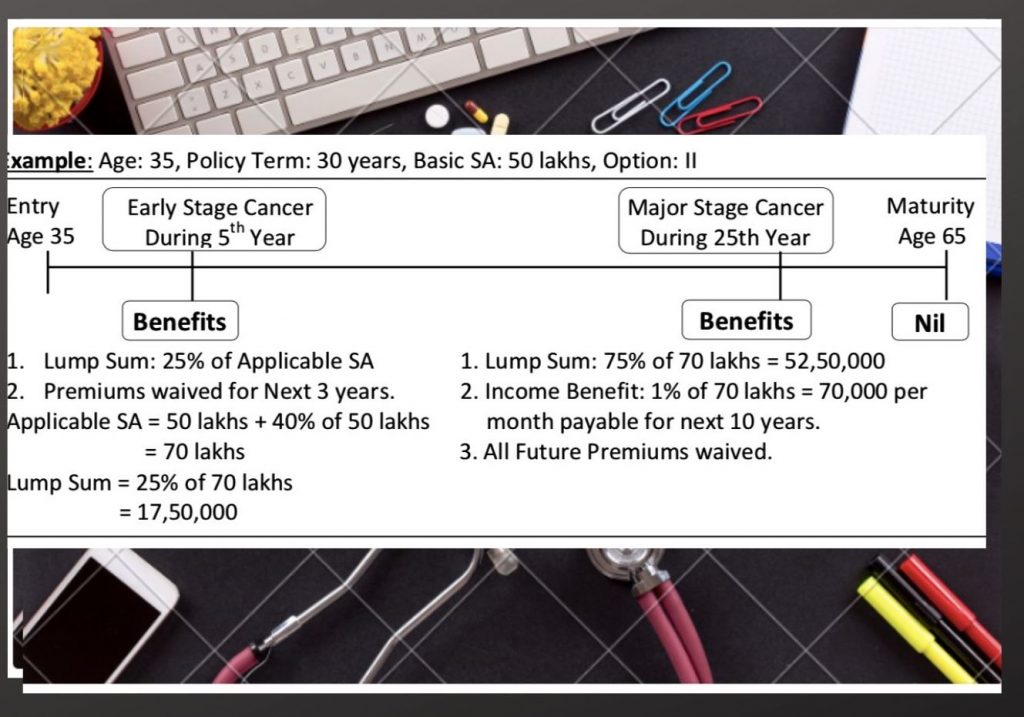

Option II: Increasing Sum Assured – Sum Assured increases by 10% of Basic SA every year for first five years or until diagnosis of first event of cancer whichever is earlier.

After diagnosis of any cancer there will not be any further increase of Sum Assured. Suppose you take 10 lac cancer cover Insurance for 30 years ,means you Sum assure is Rs 10 lac and it will Increase 10% every year till it reaches Rs 15 Lac . Your Insurance Premium will also increase.

Applicable Sum Assured for Benefits under:

Option I: Basic Sum Assured.

Option II: Basic SA during first year and increased SA thereafter for next five years. From 6th year onwards it will be 1.5times of Basic SA provided there is no event of cancer earlier.

BENEFITS of LIC Cancer Cover Plan:

- Early Stage Cancer: On first diagnosis of any of the specified Early stage Cancers:

- Lump Sum Benefit: 25% of Applicable SA.

- Premium Waiver Benefit: Premiums for next 3 year shall be waived.

- Major Stage Cancer: On first diagnosis of any of the specified Major stage Cancers:

- Lump Sum Benefit: 100% of Applicable SA minus any Claim paid under Early stage cancer.

(i.e. 75% of Applicable SA if early stage claim is paid.) - Income Benefit: 1% of Applicable SA will be paid every policy month following the payment of Lump Sum Benefit for next 10 years irrespective of Survival of the life assured and even this period of 10 years goes beyond the policy term.

- In case of death of Life assured before expiry of 10 years the remaining instalments will be paid to the nominee.

- Premium Waiver Benefit: All future premiums will be waived

- Lump Sum Benefit: 100% of Applicable SA minus any Claim paid under Early stage cancer.

- Maturity and Death Benefit: Nil

Features & Conditions of LIC Cancer Cover Plan:

- Minimum age at entry :20 years

- Maximum age at entry : 65 Years

- Minimum Policy term 10 Years

- Maximum Policy term 30 Years

- Minimum premium Rs 2400 Yearly

- Minimum Basic S.A. -Rs 10 Lac

- Maximum Basic S.A : Rs 50 Lac/- under all

Cancer Cover and Critical illness cover/ Rider taken from LIC of India and other Insurance Companies.

Waiting Period: 180 days from DOC /Revival .DOC means Date of Commencement of Risk ,in simple words ,After 180 days of taken this policy, you can get benefits.

Survival Period: No benefit is payable if life assured dies within 7 days from date of diagnosis of Early/Major stage cancer.

Premium Rates: Differs for male and female lives. Can be revised every 5 years from DOC of policy. Revised premiums will be as per age at entry.

Claims: Should be intimated within 120 days and will be settled by LIC office only (No TPA) within 30/45 days of receipt of all requirements. For any delay interest @ 2% above bank rate will be paid.

Available Riders: Nil

Mode of Payment of LIC Cancer Cover Plan:

Yearly & Half Yly only.

Grace period: One month- Min 30 days. Paid up/Surrender/Policy Loan: Nil Revivals: Within 2 years of FUP.

Back Dating: Not Allowed

On Basic Premiums : u/s 80D Lump Sum/Income Benefit : u/s 10(10D)