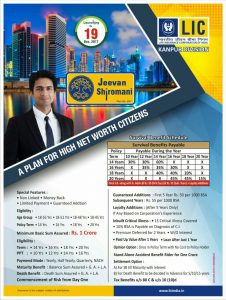

LIC introduce LIC’s Jeevan Shiromani Plan (Plan No.947) with effect from 19th December, 2017.

LIC’s Jeevan Shiromani plan is a non-linked, with-profits, limited premium payment money back life insurance plan especially designed for targeted segment of High Net-worth Individuals. This plan provides financial support for the family not only in case of death of Life Assured during the policy term but also provides for payment of a lumpsum amount on diagnosis of any of the specified Critical Illnesses.

LIC’s Jeevan Shiromani plan is a non-linked, with-profits, limited premium payment money back life insurance plan especially designed for targeted segment of High Net-worth Individuals. This plan provides financial support for the family not only in case of death of Life Assured during the policy term but also provides for payment of a lumpsum amount on diagnosis of any of the specified Critical Illnesses.

Earlier it was plan no 847 ,now it is plan number 947.

Under this plan Guaranteed Additions shall accrue at the rate of Rs.50 per thousand Basic Sum Assured for the first five years and Rs.55/- per thousand Basic Sum Assured from 6th policy year till the end of premium paying term as detailed in Para 4 below.

In addition, the policy shall participate in the profits in form of Loyalty Additions .

The benefits and other details of the Insurance plan are given below.

ELIGIBILITY CONDITIONS AND RESTRICTIONS FOR BASE PLAN:

a) Minimum Basic Sum Assured : Rs. 100,00,000/-

b) Maximum Basic Sum Assured : No Limit (The Basic Sum Assured shall be in multiples of Rs. 500,000/-)

c) Policy Term : 14, 16 , 18 and 20 years

d) Premium Paying Term (PPT) : (Policy term less 4) years

e) Minimum Age at entry : 18 years (completed)

f) Maximum Age at entry

55 years (nearer birthday) for policy term 14 years

51 years (nearer birthday) for policy term 16 years

48 years (nearer birthday) for policy term 18 years

45 years (nearer birthday) for policy term 20 years

g) Maximum Age at Maturity : 69 years (nearer birthday) for policy term 14 years

67 years (nearer birthday) for policy term 16 years

66 years (nearer birthday) for policy term 18 years

65 years (nearer birthday) for policy term 20 years

Date of Commencement of Risk: Under this plan the risk will commence immediately from the Date of issuance of policy.

Date of issuance of policy is a date when a proposal after underwriting is accepted as a policy and the contract gets effected.

BENEFITS UNDER THE BASE PLAN:

The benefits payable under an inforce policy are as under:

a) Death Benefit:

On death during first five years: “Sum Assured on Death” along with accrued Guaranteed Additions shall be payable.

On death after completion of five policy years but before the date of maturity: “Sum Assured on Death” along with accrued Guaranteed Additions and Loyalty Addition, if any, shall be payable.

Where “Sum Assured on Death” is defined as the higher of

- 10 times of annualised premium or

- Absolute amount assured to be paid on death, i.e. 125% Basic Sum Assured

This death benefit shall not be less than 105% of all the premiums paid as on date of death.

Premiums referred above shall not include any taxes, extra amount chargeable under the policy due to underwriting decision and rider premiums, if any.

b) Survival Benefit:

On the life assured surviving to each of the specified durations during the policy term, a fixed percentage of Basic Sum Assured shall be payable. The fixed percentage for various policy terms is as below:

For policy term 14 years: 30% of Basic Sum Assured on each of 10th and 12th policy anniversary For policy term 16 years: 35% of Basic Sum Assured on each of 12th and 14th policy anniversary For policy term 18 years: 40% of Basic Sum Assured on each of 14th and 16th policy anniversary For policy term 20 years: 45% of Basic Sum Assured on each of 16th and 18th policy anniversary

c) Maturity Benefit:

On the life assured surviving to the end of the policy term, “Sum Assured on Maturity” along with accrued Guaranteed Additions and Loyalty Addition, if any, shall be payable.

Where “Sum Assured on Maturity” is as under:

For policy term 14 years: 40% of Basic Sum Assured For policy term 16 years: 30% of Basic Sum Assured For policy term 18 years: 20% of Basic Sum Assured For policy term 20 years: 10% of Basic Sum Assured

d) Inbuilt Critical Illness Benefit:

- On first diagnosis of any one of the 15 Critical Illnesses as specified below, provided the policy is inforce on the date of diagnosis, the following benefits/ facilities shall be available.

- Lumpsum Benefit: Inbuilt Critical Illness Benefit equal to 10% of Basic Sum Assured shall be

payable. - The claim is proved as admissible to the satisfaction of the Corporation

Want to be LIC advisor ? click here

The list of the 15 Critical Illnesses conditions covered under LIC Jeevan Shiromani are:

- Cancer of specified severity:

- Open chest CABG

- Myocardial infarction

- Kidney failure requiring regular dialysis

- Major organ /bone marrow transplant (as recipient)

- Stroke resulting in permanent symptoms

- Permanent paralysis of limbs

- Multiple sclerosis with persisting symptoms

- Aortic surgery

- Primary (idiopathic) pulmonary hypertension

- Alzheimer’s disease/ dementia

- Blindness

- Third degree burns

- Open heart replacement or repair of heart valves

- Benign brain tumour