New LIC Plan Bima Shree is non Market-linked ,limited premium payment ,money back plan along with inbuilt critical illness for high net worth individuals.

Featutres of Bima Shri

A ge Group – Policy Term

18 – 55 yrs – 14 yrs

18 – 51 yrs – 16 yrs

18 – 48 yrs – 18 yrs

18 – 45 yrs – 20 yrs

PPT (Premium Payable Term)

=Policy Term – 4years

Maturity Benefit of Bima Shree =

Maturity Sum Assured +Guaranteed Additions +Loyalty Additions

What is Guaranteed Addition of Bima shree plan?

First 5 Years of policy term ,Rs.50 per 1000 BSA will be added.

Subsequent Years of policy paying term ,Rs.55 per 1000 BSA will be added.

Loyalty addition will be paid after paying 5 years of premium.it is based on LIC experience.

Take a Example

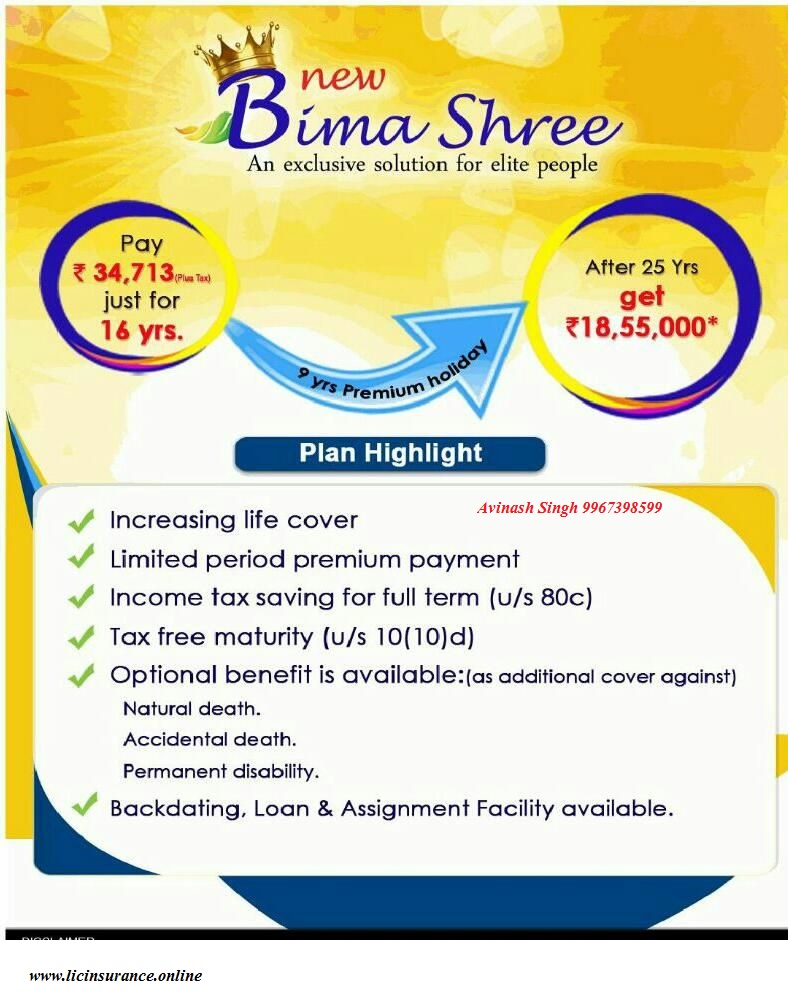

Mr ABC ,age 35 yrs has selected term for 20 yrs then his PPT(premium paying term) would be 16 yrs.

As he has chosen ,10 lac as Sum assured.

Death Benefit= Death SA + GA+ LA

Highest of:

125% of BSA or 10 times AP or 105% of Total Premiums Paid

(excluding GST)