What is LIC New Pension Plus 867 ?

This is a Regular and Single Premium, Non-Participating, Unit Linked (ULIP) Individual Pension Plan to build corpus to be converted into regular Income.

Person can choose the amount of premium as he desires to pay and as he want to get pension.

Premium paid shall be subject to allocation charges, means after deduction allocation charges ,his money will be invested by LIC.

At the end of specified durations, Guaranteed additions as a percentage of Annualized / Single Premium shall be added to the unit fund under in force policy

LIC New Pension Plus Plan 867 Details

New Pension Plus plan can be purchased either as a single premium payment policy or a regular premium payment.

Under the regular premium, the premium shall be payable over the term of the policy.

The policyholder will have the option to select the amount of premium payable and policy term subject to the minimum and maximum limits – to be decided as per policy term and vesting age, Its good that vesting age start at the age of 35 years of policy holder.

LIC is also providing to extend the accumulation period or defer period within the same policy subject to terms and conditions.

LIC New Pension Plus Plan – Regular Income

Under the regular premium, the premium shall be payable over the term of the policy.

The policyholder will have the option to select the amount of premium payable and policy term subject to the minimum and maximum limits – to be decided as per policy term and vesting age.

The policyholder will have the option to select the amount of premium payable and policy term subject to the minimum and maximum limits – to be decided as per policy term and vesting age, Its good that vesting age start at the age of 35 years of policy holder.

LIC is also providing to extend the accumulation period or defer period within the same policy subject to terms and conditions.

LIC New Pension Plus Plan 867 Benefits

LIC New Pension Plus Plan – Regular Income

LIC New Pension Plus aims to build a corpus by systematic and disciplined savings.

The amount on completion of the term can be converted into regular income.

For regular income, the policyholder will have to buy an annuity plan.

Eligibility Criteria for LIC Pension Plus

- Minimum Age 25 yrs, Maximum Age 75

- Minimum Pension Starting Age =35

- Policy Term 10 Yrs to Max 42 Yrs

- Minimum Vasting Age =35

- Maximum Vasting Age 85

- Premium Payment = Single and Regular (Yrly ,Half yrly, Qtrly and Monthly)

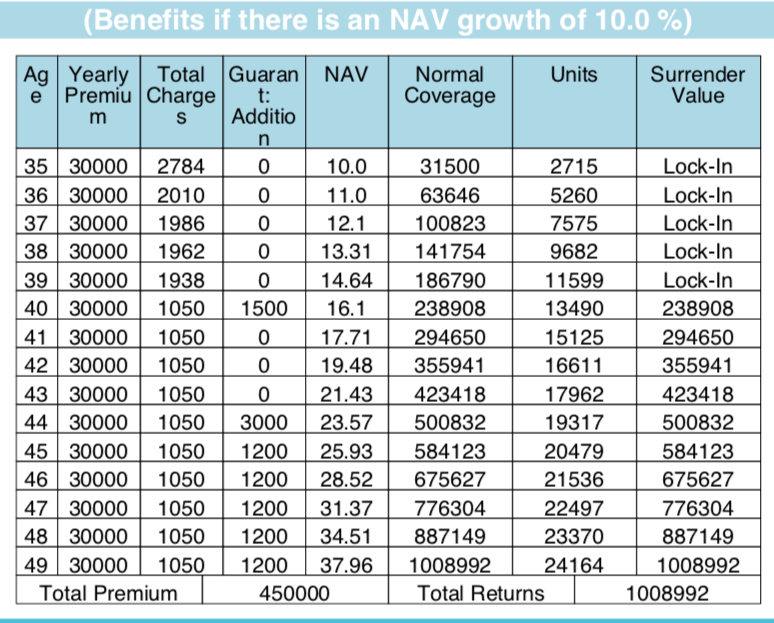

- Minimum Yrly Premium Rs 30000,

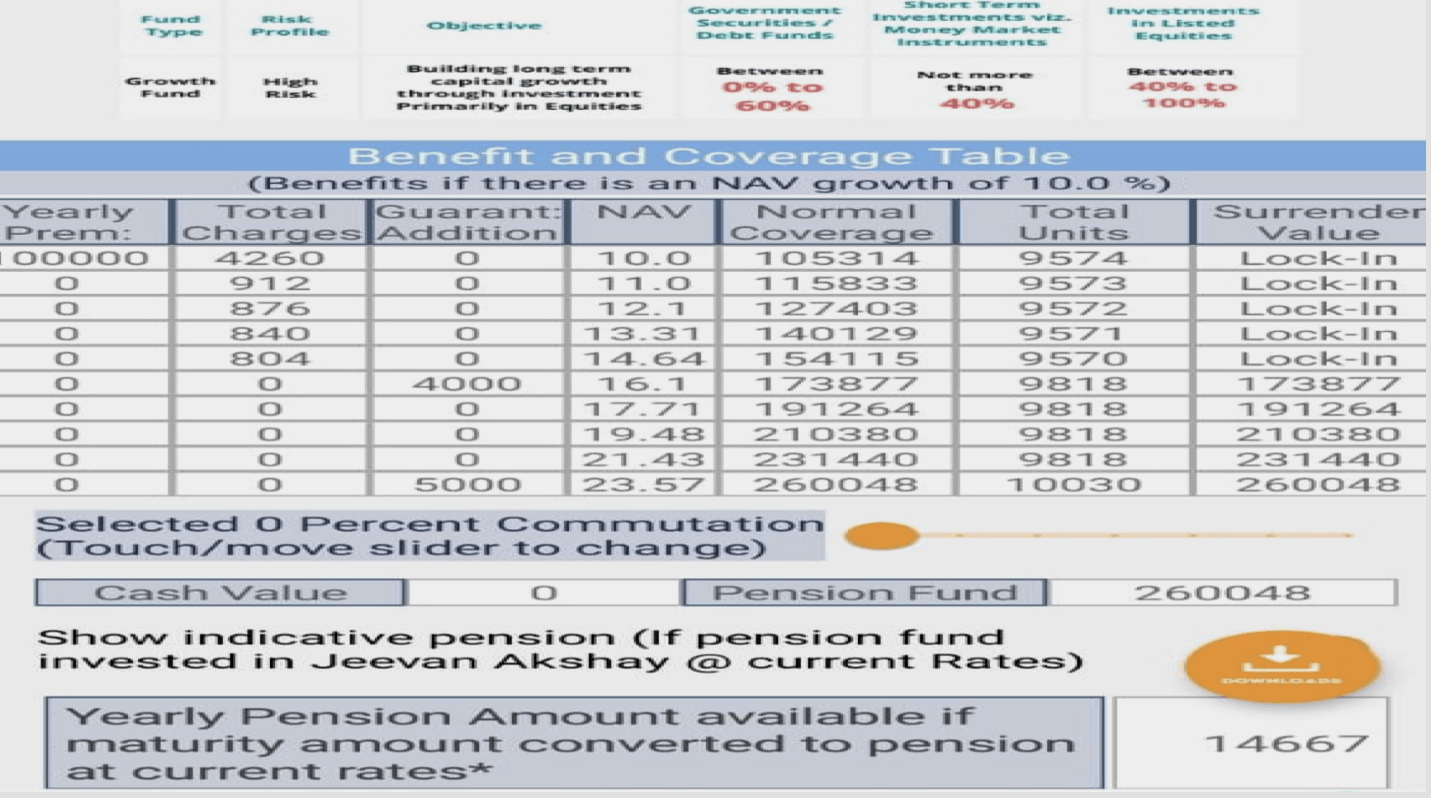

- Minimum Single Premium Rs 100000.

LIC New Pension Plus Plan Premium calculation

The policyholder will have the option to select the amount of premium payable and policy term subject to the minimum and maximum limits – to be decided as per policy term and vesting age.

LIC is also providing to extend the accumulation period or defer period within the same policy subject to terms and conditions.

LIC New Pension Plus Plan – Types Of Funds

LIC New Pension Plus Plan – Guaranteed Additions

According to the LIC, under LIC New Pension Plus, guaranteed additions shall be payable under an in-force as a percentage of one annual premium.

- The guaranteed addition on regular premium ranges from 5 per cent to 15.5 per cent.

- On a single premium payable, it will be up to 5 per cent on completion of certain years.

The amount of guaranteed actions will be used to purchase units.

Death Benefit in LIC Pension Plus Plan:

DEATH BENEFIT:

- Under In-force Policy: Higher of Unit Fund Value as on date of intimation of death or Assured Death Benefits will be payable.

- Assured Death Benefit = 105% of total premiums received upto date of death reduced by partial withdrawal made during two-year period immediately preceding the death of life assured.

- Under Discontinued Policy during 5 years lock in Period: Discontinued Fund Value as on date of intimation of death will be payable.

- Under Discontinued Policy after 5 years lock in Period: Higher of Unit Fund Value as on date of intimation of death or Paid-Up Sum Assured will be payable. Paid-Up Sum Assured = 105% of total premiums received upto date of FUP reduced by partial withdrawal made during two-year period immediately preceding the death of life assured.

LIC New Pension Plus Plan Features

- Switching between funds.

- Settlement option of Death Benefit to nominee over 5 years.

- Partial Withdrawal from 6th year only for stipulated reasons. (Maximum 3 times)

- Top Up not allowed.

- Alteration to other Plan not allowed.

- Mode of Payment: (Yearly, Half Yly, Qly & Mly NACH only. Rebates: Nil )

- Grace Period: 15 days for monthly mode and 30 days for other modes.

LAST ULIP Plan Performance:

LIC New Pension Plus Plan Return

Now the question remains How much one will get as Pension?

Suppose one has paid premium for specific period (term) ,they will get fund corpus at the end of term and pension will start as per the interest rate ie declared by LIC by that time, He /She can withdraw 60% of the corpus at the end of term .

Also One have option to go for another Insurer with 50% of their corpus ,if other Insurer would give better rate of return.