What Is an Income Tax?

An income tax is a necessary tax that governments imposed on income earned by businesses and individuals in an year.As per law, every individual must file an income tax return annually to determine their tax obligations.

Income taxes are a source of revenue for governments.They are used to fund public services, pay government obligations, and provide goods for citizens. There are investments, like LIC insurance policies, other Insurance Policies ,Government Bond etc to exempt from income taxes.In India there is limit to save Income Tax that is upto Rs 150,000.

What is Income Tax Slab in INDIA

The basic exemption limit for an individual depends on their age and residential status. According to age, resident individual taxpayers are divided into three categories:

- Resident individuals below the age of 60 years

- Resident senior citizens of age between 60 years and above but below 80 years

- Resident super senior citizens of above 80 years of age

latest income tax slabs for FY 2018-19 and FY 2019-20.

Income tax slabs for resident individual below 60 years of age

| Taxable income slabs | Income tax rates and cess |

Up to Rs 2.5 lakh | Nil |

Rs 2,50,001 to Rs 5,00,000 | 5% of (Total income minus Rs 2,50,000) + 4% cess |

| Rs 5,00,001 to Rs 10,00,000 | Rs 12,500 + 20% of (Total income minus Rs 5,00,000) + 4% cess |

| Rs 10,00,001 and above | Rs 1,12,500 + 30% of (Total income minus Rs 10,00,000) + 4% cess |

Income tax slabs for resident individual between 60 and 80 years of age (Senior Citizen)

| Taxable income slabs | Income tax rates and cess |

| Up to Rs 3 lakh | Nil |

| Rs 3,00,001 to Rs 5,00,000 | 5% of (Total income minus Rs 3,00,000) + 4% cess |

| Rs 5,00,001 to Rs 10,00,000 | Rs 10,000 + 20% of (Total income minus Rs 5,00,000) + 4% cess |

| Rs 10,00,001 and above | Rs 1,10,000 + 30% of (Total income minus Rs 10,00,000) + 4% cess |

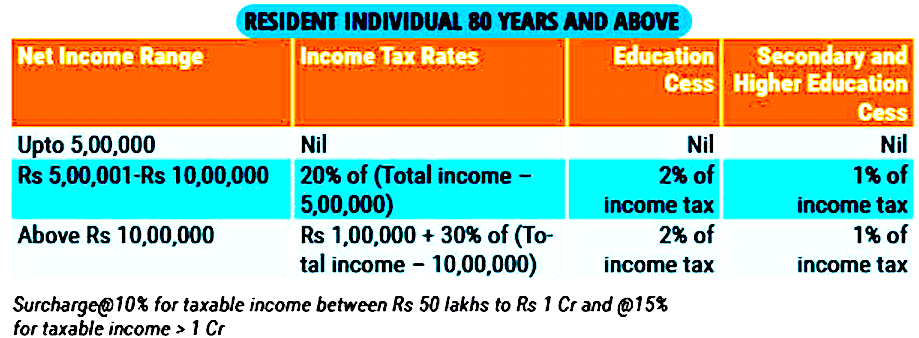

Income tax slabs for resident individual above 80 years of age (Super Senior Citizen)

| Taxable income slabs | Income tax rates and cess |

| Up to Rs 5 lakh | Nil |

| Rs 5,00,001 to Rs 10,00,000 | 20% of (Total income minus Rs 5,00,000) + 4% cess |

| Rs 10,00,001 and above | Rs 1,00,000 + 30% of (Total income minus Rs 10,00,000) + 4% cess |

As per the Indian Budget 2019 announcement, no changes in the income tax slabs and rates have been proposed. A rebate of Rs 12,500 will be available for all taxpayers with taxable income up to Rs 5 lakh. This rebate will be available under Section 87A of the Income Tax Act. Also, standard deduction for financial year 2019-20 would be Rs 50,000.

For the FY 2019-20, new surcharge rates have been introduced for the super rich.

Surcharges to be levied for FY 2019-20:

| Taxable Income | Surcharge (%) |

| Income above Rs 50 lakh but below Rs 1 crore | 10 |

| Income above Rs 1 crore but below Rs 2 crore | 15 |

| Income above Rs 2 crore but below 5 crore | 25 |

| Income above Rs 5 crore | 37 |

For non-resident individuals (NRI), the basic exemption limit is of Rs 2.5 lakh in a financial year irrespective of their age. Surcharge as mentioned in the table above will be levied on the taxable income.

In Budget 2018, cess on income tax was increased to 4 per cent for FY 2018-19 onwards from 3 per cent for FY 2017-18 across the board for taxpayers. Due to the hike in cess, the tax liability for the highest slab (assuming an income of Rs 15 lakh) has increased by Rs 2,625. In the middle income tax slab, the tax outgo increases by Rs 1,125, and there is a nominal increase in the tax liability of Rs 125 for lowest income tax slab.